1. Introduction

Economic development refers to the process through which a nation’s overall standard of living improves, encompassing factors such as income growth, better healthcare, increased literacy, and improved infrastructure. Measuring economic development requires both quantitative and qualitative assessments. While economic growth is often gauged by increases in the production of goods and services, broader indicators are necessary to capture the well-being of a country’s population. This chapter explores the various methods used to evaluate economic development, the challenges of economic transition, and the political risks businesses face when operating internationally. It also examines the economic transformations of China and Russia, highlighting their unique experiences in shifting from centrally planned economies to market-driven systems.

2. Measuring Economic Development

Economic development is assessed using multiple indicators, each offering a different perspective on a country’s progress.

One of the most widely used measures is Gross Domestic Product (GDP), which represents the total value of goods and services produced within a country in a given year. A related measure, Gross National Income (GNI), includes income earned from abroad, providing a broader picture of a nation’s financial activity. However, these figures alone do not account for differences in living costs, which is why Purchasing Power Parity (PPP) is often used to adjust GDP and GNI to reflect the actual purchasing power of consumers in different countries.

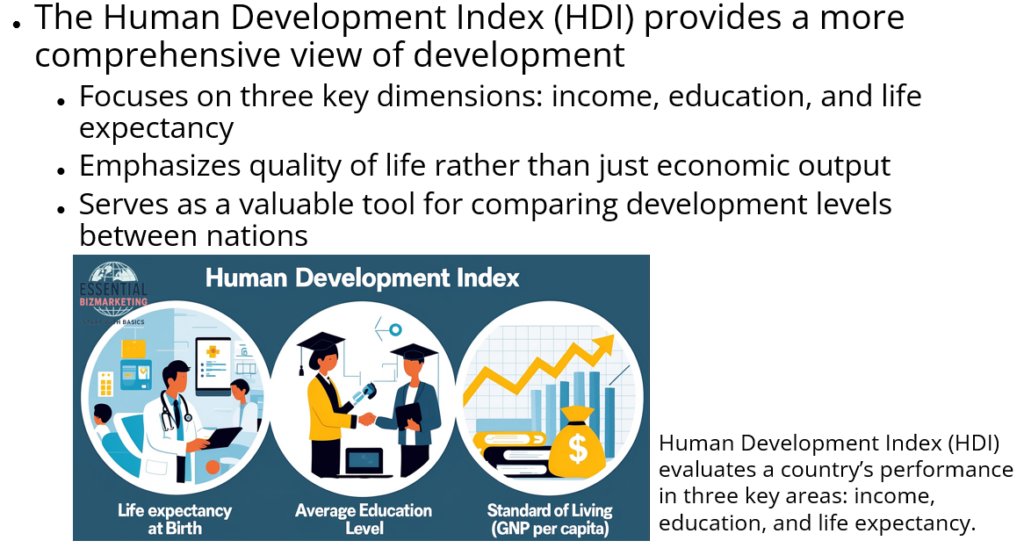

To capture the human aspect of development, the Human Development Index (HDI) evaluates a country’s performance in three key areas: income, education, and life expectancy. Unlike GDP or GNI, the HDI emphasizes the quality of life rather than just economic output, making it a valuable tool for comparing development levels across nations.

Countries are commonly classified into three categories based on their level of development. Developed countries, such as the United States, Germany, and Japan, are highly industrialized, with strong infrastructure, high incomes, and advanced social services. Newly industrialized countries (NICs), including China, Brazil, and South Korea, are experiencing rapid economic growth and industrialization but have not yet reached full developed status. Meanwhile, developing countries face significant economic challenges, including low incomes, weak infrastructure, and heavy reliance on agriculture or resource extraction.

3. Economic Transition and Its Challenges

Some nations undergo a transformation known as economic transition, shifting from centrally planned economies to free-market systems. This transition is often difficult, as it requires significant structural changes and adjustments at both the governmental and societal levels.

One major challenge in economic transition is the lack of managerial expertise. Under central planning, economic decisions were made by the government rather than by business leaders, leaving a gap in entrepreneurial and management skills necessary for a competitive market economy. Additionally, transitioning economies often struggle with a shortage of capital, which is needed for infrastructure development, financial institutions, and education systems that support long-term economic growth.

Cultural resistance to economic change can also pose difficulties. In many former socialist economies, people were accustomed to government-provided jobs and subsidies. The shift toward privatization and individual responsibility can create uncertainty and social unrest. Furthermore, unsustainable economic practices, including poor environmental regulations and inadequate healthcare systems, can hinder progress and lead to long-term economic instability.

4. Political Risk and Its Impact on Business

Political risk refers to the likelihood that political instability or government actions will negatively affect business operations. Companies operating internationally must consider several types of political risk, including conflict and violence, terrorism, government intervention, and sudden regulatory changes.

One of the most severe forms of political risk is conflict and violence, which can arise from civil unrest, ethnic tensions, or disputes between nations. Businesses operating in such environments face disruptions in production, supply chain issues, and potential harm to employees. Additionally, terrorism and kidnapping pose risks in certain regions, particularly for multinational corporations and their executives.

Governments may also take direct action against businesses through property seizure, which can occur in different forms. Confiscation refers to the forced transfer of assets without compensation, while expropriation involves compensation, though often at unfairly low levels. In some cases, entire industries are taken over through nationalization, a process in which the government assumes control of key sectors such as energy or telecommunications.

Other forms of political risk include policy changes, such as new restrictions on foreign ownership or trade regulations that disadvantage international firms. Some governments impose local content requirements, which mandate that a certain percentage of goods or services be produced domestically, often forcing foreign companies to adjust their supply chains or hire local labor.

5. Managing Political Risk

Businesses can adopt several strategies to manage political risk and minimize its impact on operations. One approach is adaptation, which involves modifying business practices to align with local conditions. This can include forming partnerships with domestic firms, adjusting product offerings to meet cultural preferences, or complying with local regulatory requirements.

Another key strategy is information gathering, which helps companies anticipate political changes and prepare accordingly. By monitoring news reports, consulting with experts, and maintaining connections with local business communities, firms can make informed decisions about their investments.

Political influence is also an important tool for managing risk. Many businesses engage in lobbying, where they work with policymakers to advocate for favorable regulations and economic policies. While ethical concerns arise regarding lobbying practices, it remains a common method for companies to safeguard their interests in foreign markets.

6. Case Studies: Economic Transition in China and Russia

China and Russia provide two distinct examples of nations transitioning from centrally planned economies to market-oriented systems.

China’s transition began in the late 1970s, when the government introduced reforms allowing private business ownership and foreign investment. Over the decades, the country has experienced rapid economic growth, urbanization, and industrialization. However, challenges remain, including income inequality, unemployment among migrant workers, and political tensions. A key aspect of doing business in China is guanxi, a system of personal relationships that plays a crucial role in securing business deals and navigating bureaucratic processes.

Russia’s transition has been more turbulent. Following the collapse of the Soviet Union, the country struggled with economic instability, corruption, and legal uncertainties that made foreign investment risky.

While some business leaders and politicians benefited from privatization, many ordinary citizens experienced economic hardship. Russia continues to face issues such as political instability, nationalist sentiment, and challenges in fostering a stable investment climate. Government intervention in business, including the targeting of private firms and foreign investors, remains a significant concern for international companies.

7. Conclusion

Economic development is a complex process influenced by political stability, market conditions, and international relationships. While some nations successfully transition to market economies, others face significant obstacles that slow progress. Businesses operating in international markets must remain adaptable, well-informed, and strategic in managing risks while taking advantage of new opportunities. As globalization continues to reshape economic landscapes, understanding the dynamics of economic development and political risk is essential for both governments and businesses seeking sustainable growth.

Related videos

- Company Case Studies in Economic Development, Political Risk & Transition

- Title: McDonald’s Exit from Russia

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.