Index of Economic Freedom

To conduct business in a foreign country, companies need to analyze the local business environment. One useful tool for this analysis is the Index of Economic Freedom, provided by the Heritage Foundation.

The Economic Freedom Index serves as a key measure of a country’s economic environment, evaluating how freely businesses and individuals can operate within its economy. This index is based on four core factors: Rule of Law, Government Size, Regulatory Efficiency, and Market Openness. Each factor is further divided into 12 components, all of which are assessed on a 0 to 100 scale, with higher scores reflecting greater economic freedom.

Rule of Law examines the strength of property rights, judicial effectiveness, and government integrity—ensuring that businesses and individuals are protected by a stable legal framework. Meanwhile, Government Size looks at how much the government intervenes in the economy through taxation, spending, and overall fiscal health. A country with excessive government spending and high tax burdens tends to have lower economic freedom.

Regulatory Efficiency plays a crucial role in determining how easily businesses can operate. This includes factors such as the ease of starting and running a business, labor market flexibility, and price stability. Markets with fewer bureaucratic hurdles and less government intervention in wages and prices generally score higher.

Lastly, Market Openness assesses a country’s trade policies, investment regulations, and financial freedom. Nations with lower tariffs, fewer restrictions on foreign investment, and an independent financial sector tend to perform better in this category.

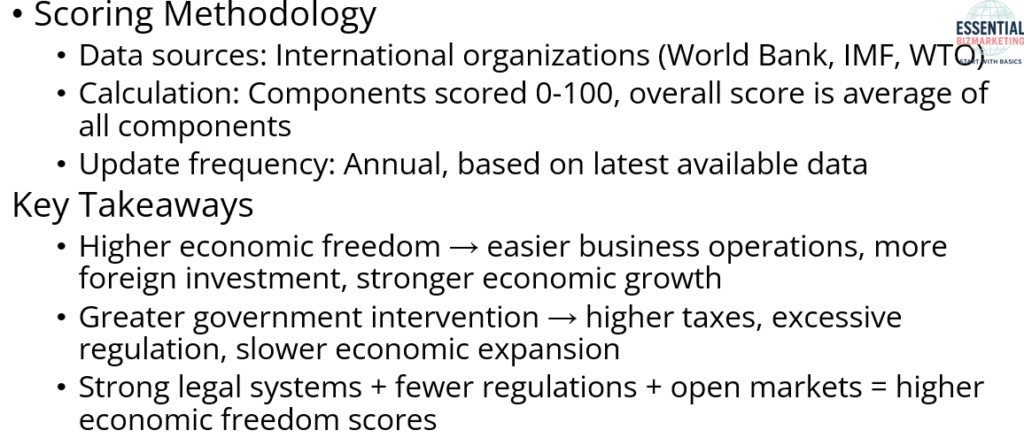

The Economic Freedom Index score is derived from data provided by institutions like the World Bank, IMF, and WTO. These scores are updated annually to reflect the most recent global economic conditions.

Ultimately, higher economic freedom allows businesses to thrive, attracts foreign investment, and fosters economic growth. Conversely, excessive government control can stifle economic dynamism through high taxation and restrictive regulations. Countries that maintain strong legal institutions, minimal regulatory barriers, and open trade policies generally achieve higher economic freedom scores.

By analyzing these factors, the Economic Freedom Index provides valuable insight into the role of government policies, market conditions, and legal protections in shaping a nation’s economic prosperity.

Bibigo case

CJ CheilJedang recently decided to establish a Bibigo production facility in Hungary. Before making such a decision, it is likely that the company conducted a thorough comparison of several potential locations. Given its proximity, Poland was probably one of the countries considered as a possible alternative. Therefore, it is worth examining the level of economic freedom in both Hungary and Poland to assess their suitability as production facility locations.

To make an informed evaluation, key economic factors such as rule of law, government size, regulatory efficiency, and market openness should be analyzed. These aspects can significantly influence business operations, affecting factors like property rights protection, tax burden, labor market flexibility, and trade conditions. Understanding these elements will provide valuable insights into why Hungary was chosen and whether Poland might have offered a competitive alternative.

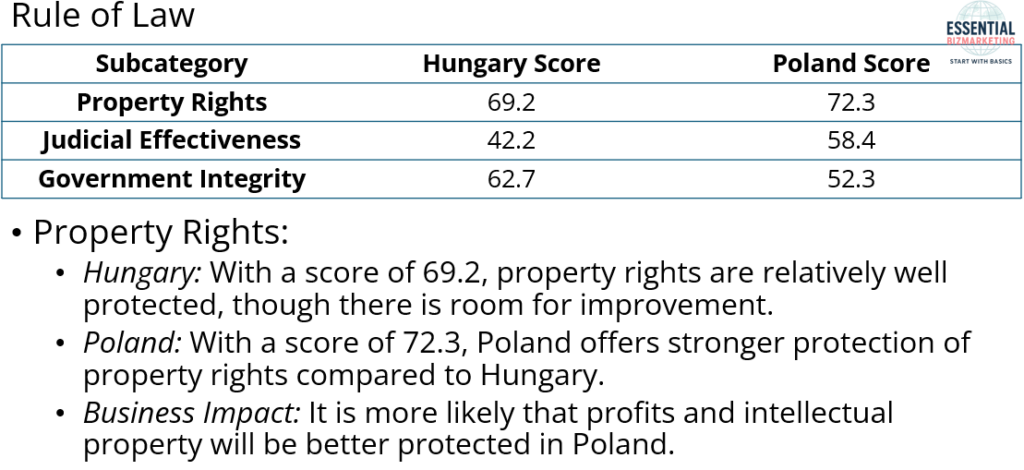

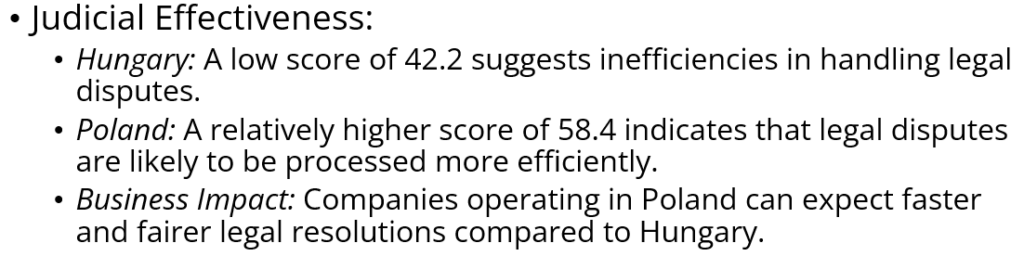

1. Rule of Law

Poland offers stronger legal foundations than Hungary, particularly in property rights protection and judicial effectiveness. Businesses operating in Poland are more likely to benefit from clear legal safeguards for both physical and intellectual property, along with a judicial system that is more efficient in resolving disputes. However, Hungary demonstrates a slight advantage in terms of government integrity, suggesting that companies there may face fewer issues related to corruption and favoritism. This presents a trade-off: Poland ensures legal reliability, while Hungary may offer a more transparent administrative environment in day-to-day operations.

2. Government Size

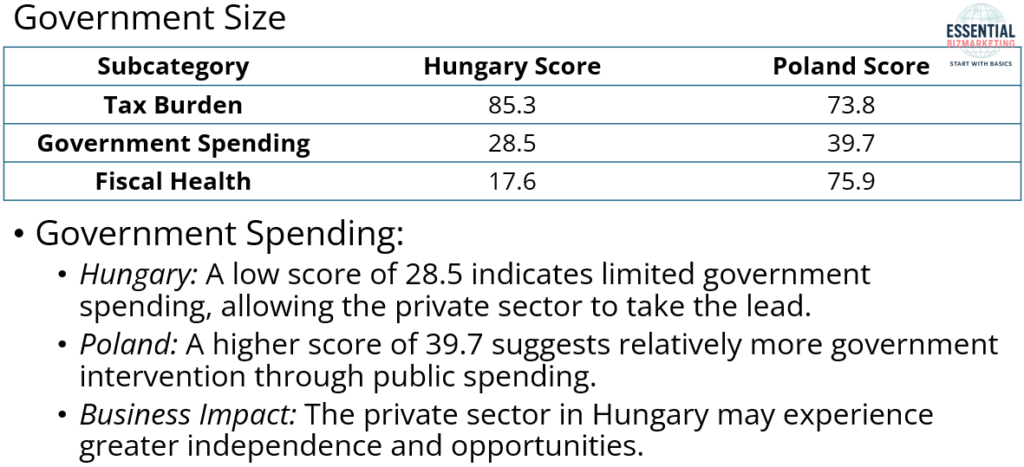

This category reveals a contrast between long-term stability and short-term cost efficiency. Poland exhibits stronger fiscal health, indicating a more stable macroeconomic environment and lower risks of fiscal disruptions. Hungary, on the other hand, maintains a notably lower tax burden and smaller government spending, which translates to greater financial flexibility for businesses. While Poland’s fiscal stability provides security for long-term investments, Hungary appeals to cost-sensitive firms by enabling higher after-tax profits and less direct government involvement in the economy.

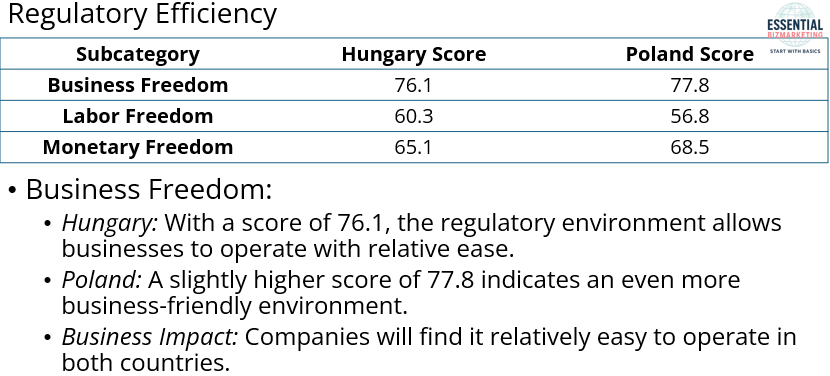

3. Regulatory Efficiency

Poland holds a slight advantage in business freedom and monetary freedom, offering smoother regulatory procedures and more stable pricing conditions, which support a predictable business environment. Meanwhile, Hungary outperforms in labor freedom, with a more flexible labor market that allows companies to adjust their workforce more easily in response to changing economic conditions.

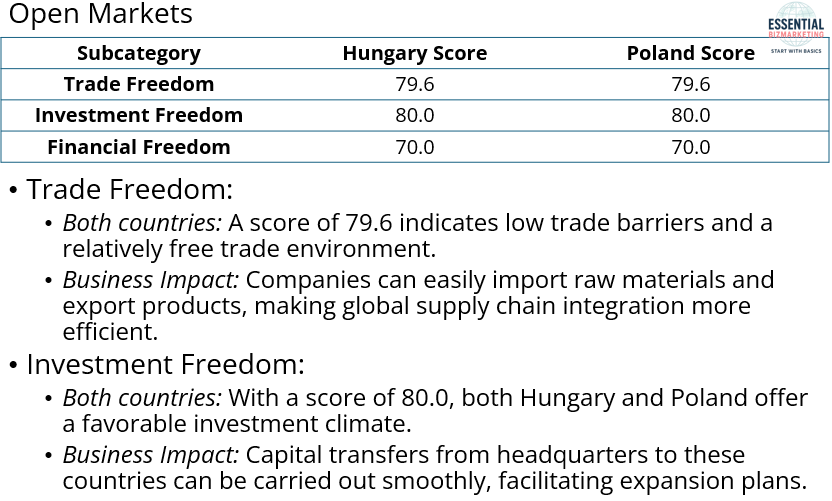

4. Open Markets

Hungary and Poland show similar levels of trade freedom, with low trade barriers that facilitate the smooth import of raw materials and export of finished goods. In terms of investment freedom, both countries provide open environments for foreign direct investment, allowing companies to move capital with few restrictions. Likewise, financial freedom is comparable, with relatively open banking systems that enable access to financing, though some government influence remains. Given these similarities, market openness is unlikely to be a decisive factor when choosing between the two.

In sum, Poland offers a more stable and predictable economic environment, making it a preferable choice for businesses focused on long-term investment security. Hungary, with its lower taxes and greater labor flexibility, may appeal to businesses seeking short-term cost advantages, but its weaker fiscal position and legal protections could pose risks in the future. Therefore, for companies prioritizing long-term stability, legal security, and a sound macroeconomic environment, Poland presents itself as the stronger investment destination.

Conclusion: Why Was Hungary Chosen?

Despite Poland’s higher overall ratings in property rights protection, judicial effectiveness, and fiscal health, the decision to establish a production site in Hungary was likely driven by cost reduction and operational flexibility. Hungary’s lower corporate tax rate of 9% and relatively lower labor costs help businesses reduce their tax burden and operating expenses. Additionally, greater labor market flexibility allows companies to adjust their workforce more easily in response to economic changes, as labor laws are less restrictive. The Hungarian government also offers strong incentives to attract foreign investment, including tax reductions, subsidies, and support for facility construction. Strategically, Hungary’s central location provides logistical advantages, with proximity to major markets such as Germany and Austria, leading to lower transportation costs. Furthermore, business-friendly administrative procedures simplify regulations for establishing and operating businesses. Given these factors, companies likely chose Hungary as their production base to maximize short-term cost savings and take advantage of investment incentives rather than opting for Poland.

📚 References

CJ CheilJedang. (2024). CJ CheilJedang to build Bibigo dumpling plant in Hungary. CJ CheilJedang Press Release. Retrieved from https://www.cj.co.kr

Heritage Foundation. (2025). 2025 Index of Economic Freedom: Poland. Retrieved from https://www.heritage.org/index/country/poland

Heritage Foundation. (2025). 2025 Index of Economic Freedom: Hungary. Retrieved from https://www.heritage.org/index/country/hungary

Kim, J. (2024, March 5). CJ CheilJedang expands European market with new Hungarian production site. The Korea Times. Retrieved from https://www.koreatimes.co.kr/www/tech/2025/03/129_386781.html

OECD Corporate Tax Statistics (2023). https://www.oecd.org/tax/tax-policy/corporate-tax-statistics-database.htm

Hungarian Ministry of Finance. https://www.kormany.hu/en/ministry-of-finance

World Bank Doing Business Report (2023). https://www.doingbusiness.org/en/reports/global-reports/doing-business-2023

Eurostat Labor Market Indicators (2023). https://ec.europa.eu/eurostat/web/labour-market/overview

Hungarian Investment Promotion Agency (HIPA) – Investment Incentives. https://hipa.hu

European Commission State Aid Guidelines (2023). https://ec.europa.eu/competition/state_aid/overview_en.html

U.S. International Trade Administration – Hungary’s Logistics & Investment Potential (2023). https://www.trade.gov/country-commercial-guides/hungary

Hungarian Central Statistical Office (KSH) – Economic Reports. https://www.ksh.hu

European Logistics Market Report (2023) – Hungary’s Strategic Positioning. https://www.savills.com/research_articles/255800/370017-0

Hungarian National Bank (MNB) – Financial Freedom & Investment Conditions (2023)

https://www.mnb.hu/en

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.