Case Study: Toyota Races Ahead

Toyota Motor Corporation, the eighth-largest company worldwide, controls about 12% of the global car market with $240 billion in annual sales and 349,000 employees. The company operates globally with 53 production facilities in 28 countries, sales in over 170 countries, and 19 design and R&D centers worldwide. Toyota owns luxury brand Lexus, commercial vehicle maker Hino, and compact car manufacturer Daihatsu.

While most of Toyota’s production operations are wholly owned, some are joint ventures like TPCA with Peugeot–Citroën in the Czech Republic, which produces up to 300,000 cars annually including the Toyota Aygo, Peugeot 108, and Citroën C1.

Toyota conducts extensive planning for production capacity, facility locations, technology, and layouts. The company finances its operations through Japanese and international capital markets, American Depository Receipts (ADRs) for U.S. investors, and profits from vehicle sales.

1. Introduction to International Production Strategies

Companies operating internationally must plan production carefully, considering factors like cost efficiency, location, resource acquisition, and financial strategies. The chapter explores key decisions in production planning, resource acquisition, production concerns, and financing.

2. Formulating Production Strategies

Production strategies involve decisions regarding capacity, location, processes, and standardization.

2.1 Capacity Planning

Capacity planning assesses a company’s ability to meet market demand. Underestimating demand may result in lost sales, while overestimating can lead to financial inefficiencies. In manufacturing, companies may expand facilities or outsource production to handle demand fluctuations. Service firms, such as hotels, also use capacity planning to determine facility size.

2.2 Facilities Location Planning

The location of production facilities influences costs and efficiency. Companies consider factors like labor availability, resource access, transportation costs, and political stability when selecting sites. Multinational firms, such as Toyota and BMW, establish production facilities in foreign markets to reduce logistical costs and manage currency risks.

2.3 Centralization vs. Decentralization

Centralized production concentrates manufacturing in one location, achieving economies of scale and cost efficiency. Decentralized production spreads facilities across multiple locations, improving responsiveness to local markets. Companies selling standardized products favor centralization, while those needing local adaptation prefer decentralization.

2.4 Process Planning

Process planning determines how products are manufactured. Companies following a low-cost strategy use highly automated processes to reduce costs, whereas those pursuing differentiation strategies invest in customization and skilled labor.

2.5 Standardization vs. Adaptation

Standardized production focuses on mass-producing uniform products, benefiting from cost efficiency and consistency. In contrast, adaptation tailors products to local markets, increasing customer appeal but raising costs.

2.6 Facilities Layout Planning

Facility layout depends on production needs. In high-cost land markets, firms maximize space efficiency, while in areas with abundant land, they have more flexibility. Layout decisions affect productivity and efficiency.

3. Acquiring Physical Resources

Before starting operations, companies must secure raw materials, components, and infrastructure.

3.1 Make-or-Buy Decision

Companies decide whether to produce components in-house (vertical integration) or outsource them. Making components internally provides greater control and cost savings, while outsourcing enhances flexibility and reduces risk. For example, Dell outsources component production to suppliers but assembles its computers.

3.2 Outsourcing and Risk Management

Outsourcing can lower costs but exposes companies to risks like political instability and supply chain disruptions. Some firms diversify suppliers across multiple regions to mitigate risks.

3.3 Raw Materials and Fixed Assets

Companies acquiring raw materials consider quantity, quality, and availability. Fixed assets, such as factories and warehouses, can be acquired through purchasing or new construction (greenfield investment).

4. Key Production Concerns

Companies must balance quality, cost, and logistics.

4.1 Quality Improvement Strategies

Quality is essential for reducing waste and ensuring customer satisfaction. Total Quality Management (TQM) is a company-wide commitment to continuous quality improvement. Many firms seek ISO 9000 certification, an international quality standard, to enhance credibility.

4.2 Just-in-Time (JIT) Manufacturing

JIT minimizes inventory costs by receiving materials precisely when needed. This system reduces waste and enhances efficiency, though it requires reliable suppliers.

4.3 Reinvestment vs. Divestment

Companies reinvest when markets show growth potential but may divest when profitability is uncertain. For instance, firms continue investing in China despite bureaucratic challenges due to long-term growth prospects.

5. Financing International Operations

Companies need funds for operations, expansion, and investments.

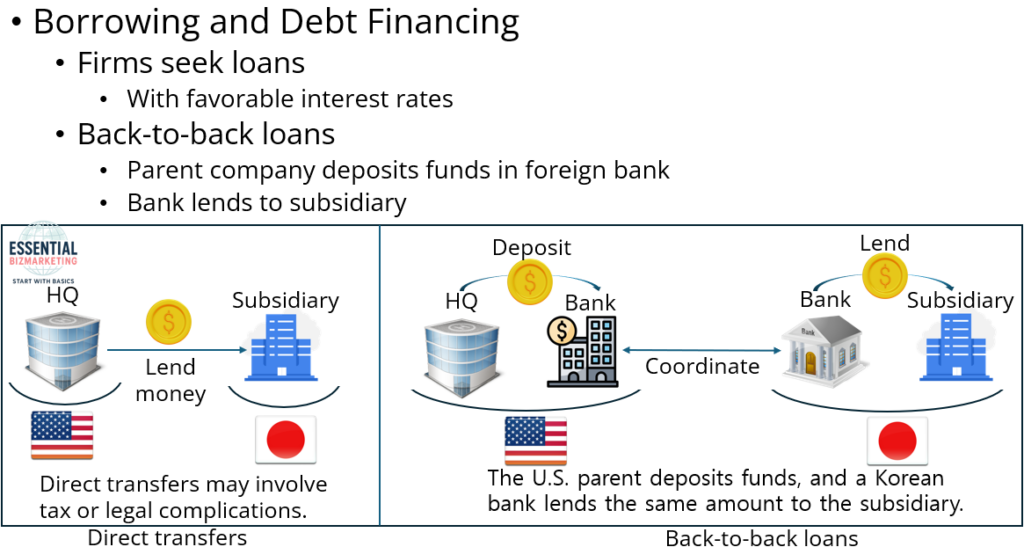

5.1 Borrowing and Debt Financing

Firms seek loans with favorable interest rates. Back-to-back loans involve a parent company depositing funds in a foreign bank, which then lends to its subsidiary.

Back-to-back loans are a way for a parent company to lend money to its foreign subsidiary using a bank as an intermediary. Instead of directly sending money, the parent company deposits funds in a bank, and the bank then lends the same amount to the subsidiary in another country. The U.S. headquarters wants to lend money to its Japanese subsidiary. However, direct transfers may involve tax or legal complications.

Instead of sending money directly, the U.S. parent company deposits funds in a U.S. bank. The U.S. bank then coordinates with a Japanese bank, which lends the same amount to the Japanese subsidiary. This way, the parent company does not directly transfer money, but the subsidiary still receives the needed funds through a local bank loan. Avoiding tax and legal issues that might arise with direct loans, this method helps the subsidiary build local credit history by borrowing from a local bank while allowing the parent company to reduce financial risks by not appearing to directly finance the subsidiary abroad. In short, a back-to-back loan allows a company to indirectly fund its foreign subsidiary by using banks as intermediaries rather than making a direct loan.

5.2 Equity Financing

Companies issue stock in international markets to access investor capital. American Depository Receipts (ADRs) allow non-U.S. firms to trade shares in the U.S. stock market, attracting American investors.

5.3 Venture Capital and Emerging Markets

Start-ups often rely on venture capital, where investors provide funding in exchange for equity. Emerging stock markets face volatility, affecting investor confidence.

5.4 Internal Financing

Companies finance operations through internal funds, such as revenues and inter-company transactions. Transfer pricing helps subsidiaries manage tax liabilities by adjusting prices for goods exchanged within the company.

5.5 Capital Structure

Companies balance equity, debt, and internal funds to optimize financial stability and minimize risk. Debt financing offers tax benefits but increases financial obligations, while equity financing reduces debt pressure.

6. Conclusion

Managing international operations requires strategic decision-making in production, resource acquisition, quality control, and financing. Companies must balance efficiency, flexibility, and risk management while aligning production strategies with corporate goals.

Related videos

- Inside Toyota’s Massive U.S. Factory

- How BMW Makes In-Demand Cars in South Carolina

- Inside Apple’s Massive Supply Chain Shift Out of China

- Why Companies Are Reshoring Manufacturing

- How Toyota’s TQM Revolutionized Manufacturing

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.