Case study: Lord of the Movies

Time Warner is a global media and entertainment leader with businesses spanning television networks, publishing, and film entertainment. Their global reach extends to audiences worldwide.

New Line Cinema’s “The Lord of the Rings” trilogy was historically successful, earning nearly $3 billion worldwide and winning 17 Academy Awards. The final film alone generated over $1 billion. New Line also found success with “The Hobbit” trilogy.

Warner Bros. achieved great success with the “Harry Potter” film series, based on J.K. Rowling’s novels, which attracted worldwide audiences. Other successful Warner Bros. productions include “The Dark Knight” and “Wonder Woman,” with the studio also creating exclusive online content.

Despite its success, Time Warner faces challenges in global expansion. Some governments worry that Hollywood productions might overshadow local creative industries or introduce values that conflict with traditional ones. Time Warner’s significant global influence is reflected in AT&T‘s $85 billion acquisition offer, which awaits regulatory approval.

1. Introduction to Government Intervention in Trade

Governments do not always allow trade to flow freely. Instead, they often intervene for political, economic, and cultural reasons. These interventions can either promote trade by supporting domestic industries or restrict trade by imposing barriers such as tariffs and quotas. Understanding why governments intervene and the instruments they use is essential for analyzing global trade policies. Additionally, the chapter explores how the global trading system, particularly through institutions like the World Trade Organization (WTO), seeks to regulate trade and resolve disputes among nations.

2. Reasons for Government Intervention in Trade

There are three primary reasons why governments intervene in trade: political, economic, and cultural motives.

Political motives often drive trade policies because government officials must consider public opinion and national interests. One of the most common political reasons for trade intervention is job protection. When foreign competition threatens domestic employment, governments may impose restrictions on imports to shield local industries. National security also plays a significant role in trade policies, particularly in sectors such as defense and energy, where self-sufficiency is critical during conflicts or economic crises. Additionally, governments may impose trade restrictions in response to what they perceive as unfair practices by other nations, such as subsidies or dumping, to retaliate and restore balance. Some powerful countries also use trade policies as a tool to influence smaller nations, leveraging economic dependence to achieve strategic goals.

Economic motives also guide government intervention in trade. One of the primary economic reasons for restricting trade is the protection of infant industries. Emerging sectors may struggle to compete against well-established foreign firms, so governments may provide temporary protection until these industries become internationally competitive. Another economic rationale is the pursuit of strategic trade policy, where governments assist domestic firms in gaining a competitive advantage in industries that benefit from economies of scale. Countries such as South Korea and Japan have historically supported large industrial conglomerates to enhance their global competitiveness.

Cultural motives are another reason why governments intervene in trade. Many nations seek to preserve their cultural identity by limiting the influence of foreign products, particularly in media and entertainment. For example, France has strict regulations requiring a significant percentage of content on radio and television to be in the French language to protect its cultural heritage from foreign influence.

3. Instruments of Trade Promotion

To encourage trade and support domestic industries, governments employ various instruments. One common approach is the use of subsidies, which provide financial assistance to local producers. These subsidies can take the form of direct cash payments, tax breaks, low-interest loans, or price support mechanisms. The goal is to help domestic industries remain competitive in both local and international markets.

Export financing is another method used to promote trade. Governments may offer loans to companies that need financial support for international expansion. In some cases, they provide loan guarantees, ensuring that financial institutions will be repaid even if the borrowing company defaults. This helps reduce the risk associated with exporting and encourages businesses to enter foreign markets.

Foreign trade zones (FTZs) are designated geographic regions where goods can be imported, stored, or processed with reduced tariffs or fewer customs restrictions. The purpose of these zones is to facilitate trade by lowering costs and simplifying bureaucratic procedures. Countries such as China and Mexico have established numerous FTZs to attract foreign investment and create jobs.

Many governments also establish special agencies to assist businesses in navigating foreign trade regulations and expanding their exports. These agencies provide valuable resources, such as market research, networking opportunities, and promotional support. For example, Japan’s External Trade Organization (JETRO) helps small and medium-sized enterprises enter the Japanese market by offering business consulting and facilitating partnerships with local distributors.

4. Instruments of Trade Restriction

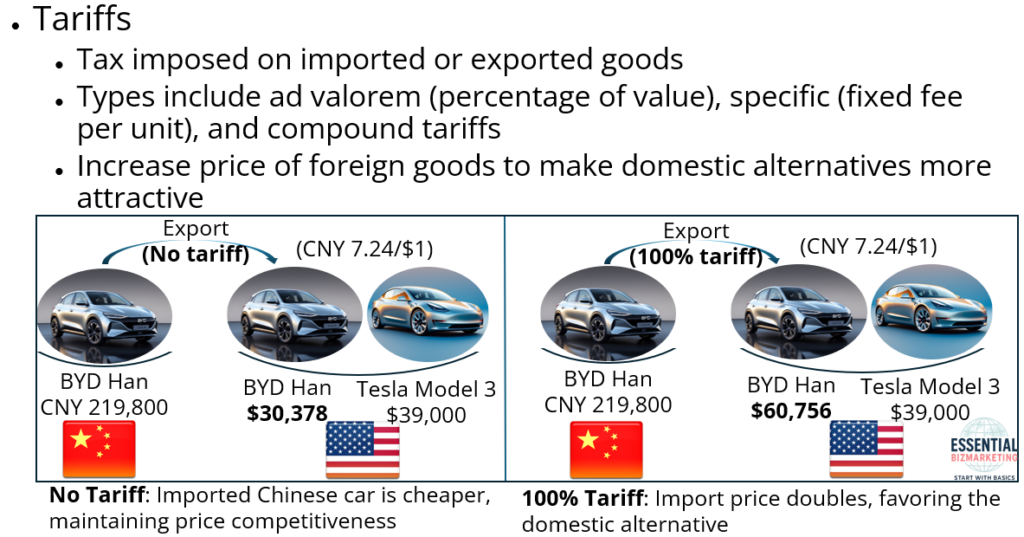

Governments also use various instruments to restrict trade when they seek to protect domestic industries or achieve strategic objectives. One of the most common tools is the tariff, which is a tax imposed on imported or exported goods. Tariffs can take different forms, including ad valorem tariffs, which are calculated as a percentage of the product’s value, specific tariffs, which are charged as a fixed fee per unit, and compound tariffs, which combine both methods. By increasing the price of foreign goods, tariffs make domestically produced alternatives more attractive to consumers.

The image illustrates the effect of tariffs on the price of imported goods. On the left side, where no tariff is applied, the Chinese car BYD Han is priced at CNY 219,800 domestically. When exported to the United States, the exchange rate of CNY 7.24 per US dollar results in a price of $30,378. In this scenario, BYD Han is cheaper than the Tesla Model 3, which costs $39,000 in the US market. Without tariffs, the Chinese car holds a competitive price advantage over the domestic alternative.

On the right side, where a 100% tariff is imposed, the same BYD Han is exported to the United States, but its price effectively doubles due to the tariff. As a result, its US market price rises to $60,756. Meanwhile, the price of the Tesla Model 3 remains at $39,000. The tariff significantly reduces the price advantage of the imported car, making the domestic alternative more attractive to consumers.

This demonstrates how tariffs can influence market dynamics by making foreign goods more expensive, thereby encouraging consumers to choose domestically produced alternatives.

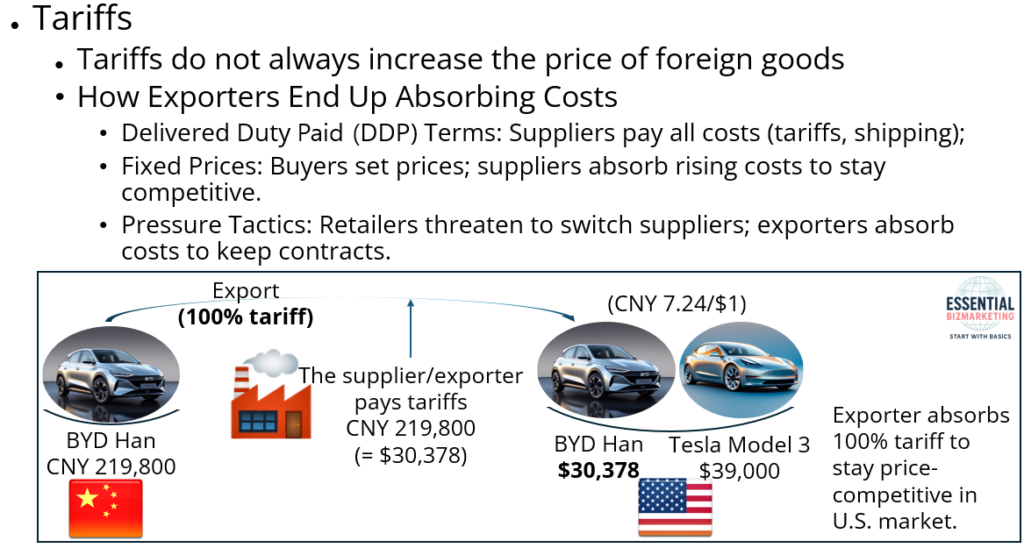

Tariffs do not always lead to higher prices for foreign goods, especially when powerful buyers are involved. In many cases, exporters end up absorbing the added costs instead. This typically happens when buyers like Walmart have strong bargaining power and negotiate terms that shift the burden of increased tariffs, shipping fees, and other expenses to the supplier. Under Delivered Duty Paid (DDP) contracts, for instance, the supplier covers all costs—including tariffs, international shipping, and customs clearance—ensuring the buyer faces no additional charges. In other cases, buyers set fixed retail prices and expect suppliers to absorb any cost increases in order to stay competitive or retain market access. Even without formal agreements, retailers may exert implicit pressure by threatening to switch suppliers if prices rise, prompting exporters to shoulder the costs to preserve the relationship. These practices are most common when suppliers lack bargaining power, whereas well-established brands like Apple or Nike are typically able to pass rising costs on to distributors or consumers. Over time, however, sustained cost absorption can threaten supplier viability, which may lead even dominant buyers to reconsider and adjust their terms.

When a Chinese electric vehicle manufacturer like BYD exports its cars to the U.S. market, high tariffs can significantly impact the final cost structure. In this example, the BYD Han is priced at CNY 219,800 in China. However, due to a 100% import tariff, the exporter must pay an additional CNY 219,800 in duties to access the U.S. market. This means the exporter absorbs a tariff cost equal to CNY 219,800—bringing the effective export expense to CNY 439,600, or approximately $60,756 at an exchange rate of CNY 7.24 per U.S. dollar. Despite this tariff burden, the BYD Han is still sold at $30,378 in the U.S. market, remaining below the Tesla Model 3, which retails for around $39,000. This implies that the exporter—rather than the American consumer—absorbs the full tariff cost to remain competitive in pricing.

Quotas are another form of trade restriction that limits the quantity of a specific product that can be imported or exported. Import quotas help protect domestic producers by reducing competition from foreign companies, while export quotas are often used to ensure an adequate supply of essential goods within the domestic market. A well-known example of an export quota system is the Organization of Petroleum Exporting Countries (OPEC), which regulates global oil supply to control prices.

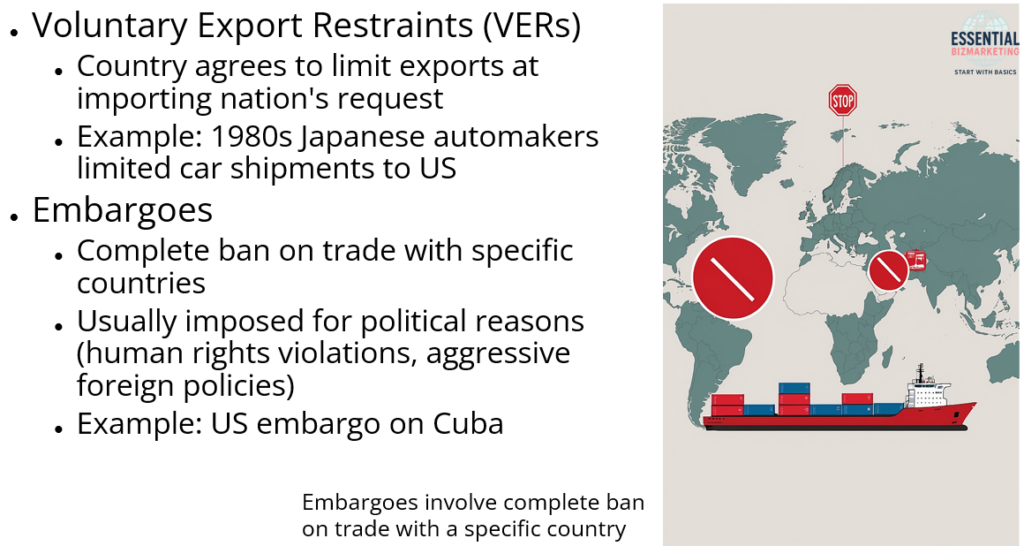

Voluntary export restraints (VERs) are a unique type of trade restriction in which a country agrees to limit its exports at the request of an importing nation. In the 1980s, Japanese car manufacturers imposed voluntary export limits on shipments to the United States to avoid harsher trade restrictions.

Embargoes represent the most extreme form of trade restriction, involving a complete ban on trade with a specific country. Governments usually impose embargoes for political reasons, such as punishing nations for human rights violations or aggressive foreign policies. The long-standing U.S. embargo on Cuba is a notable example of this practice.

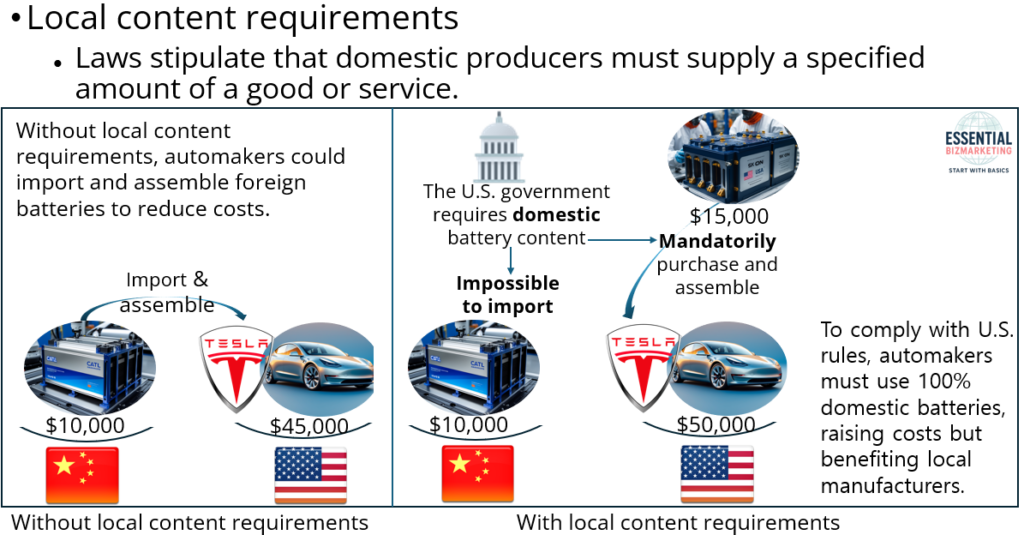

Local content requirements mandate that a certain percentage of a product be sourced domestically. These laws force foreign companies to use local labor and materials, thereby stimulating the domestic economy. For instance, the United States has regulations requiring automobile manufacturers to include a minimum percentage of domestically produced components in their vehicles.

This image illustrates how local content requirements impact the production and pricing of electric vehicles (EVs) in the United States. It contrasts a scenario without local content requirements, where automakers can freely import and assemble foreign batteries, with a scenario where domestic battery content is legally mandated.

On the left side of the image, before local content requirements were implemented, automakers could import a lower-cost CATL battery from China for $10,000 and assemble it in the U.S. This resulted in an overall EV price of $45,000 for consumers. Since there were no restrictions, manufacturers had the flexibility to minimize costs by using imported components.

On the right side, after the introduction of local content requirements, the U.S. government enforces a rule requiring domestic battery content. As a result, the import of foreign batteries becomes impossible, meaning automakers can no longer use the lower-cost CATL battery. This forces them to source batteries domestically to comply with the regulation.

Under the new policy, manufacturers are required to use domestically produced SK On batteries, which cost $15,000—a significantly higher price than the imported alternative. Consequently, the total EV price increases to $50,000. Despite the higher cost, this policy benefits local battery manufacturers and strengthens the domestic supply chain.

In sum, without local content requirements, manufacturers could opt for the more affordable imported battery, reducing costs. However, with local content requirements, the law mandates the use of domestic batteries, leading to higher vehicle costs but promoting local industry growth

Administrative delays are another way governments can restrict imports by imposing excessive bureaucratic procedures. These tactics include requiring unnecessary inspections, understaffing customs offices, and imposing lengthy licensing requirements, all of which create obstacles for foreign businesses.

Currency controls are also used to limit imports by restricting the ability of businesses to convert local currency into internationally accepted forms such as U.S. dollars or euros. By making it difficult for companies to pay for imports, governments can effectively reduce the volume of foreign goods entering their markets.

5. The Global Trading System

While many governments impose trade restrictions, international efforts have been made to reduce barriers and promote free trade. The General Agreement on Tariffs and Trade (GATT), established in 1947, was one of the first major efforts to create a global trading system. Over several decades, GATT negotiations helped reduce average tariffs from 40 percent to 5 percent and increased international trade significantly. However, as global trade became more complex, a need arose for a stronger regulatory body.

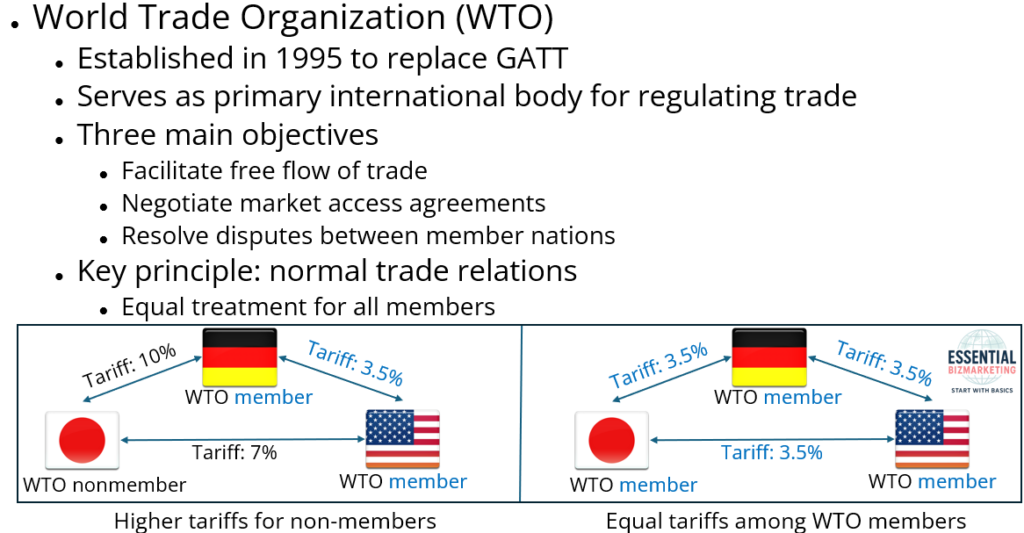

In 1995, the World Trade Organization (WTO) was established to replace GATT and serve as the primary international body for regulating trade. The WTO has three main objectives: to facilitate the free flow of trade, to negotiate market access agreements, and to resolve disputes between member nations. One of its key principles is the concept of normal trade relations, which ensures that all member countries receive equal treatment in trade agreements.

The diagrams illustrate the impact of WTO membership on trade tariffs. In the left diagram, a non-WTO member (Japan) faces higher tariffs when trading with WTO members like Germany (10%) and the U.S. (7%). This demonstrates that countries outside the WTO do not receive the benefits of lower, standardized tariffs.

In contrast, the right diagram shows the effect of WTO membership, where all three countries—Germany, the U.S., and Japan—are members of the WTO. As a result, they apply equal tariff rates (3.5%) to each other, reflecting the WTO’s principle of normal trade relations, which ensures equal treatment among member nations.

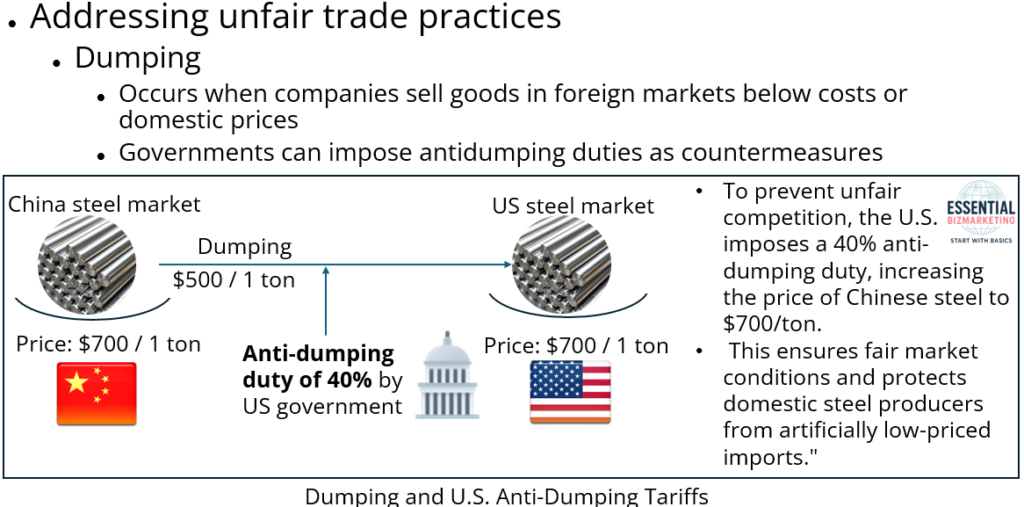

The WTO plays a crucial role in addressing unfair trade practices such as dumping and excessive subsidies. Dumping occurs when a company sells goods in a foreign market at a price lower than production costs or domestic market prices. Governments can impose antidumping duties to counteract this practice.

The image illustrates dumping and the use of anti-dumping tariffs as a countermeasure to unfair trade practices. It focuses on the case of Chinese steel exports to the U.S. and how the U.S. government responds to price distortions caused by dumping.

1. Dumping: Selling Below Market Price

In the Chinese steel market, steel is sold at $700 per ton. However, Chinese steel producers export steel to the U.S. at a much lower price of $500 per ton. This practice, known as dumping, occurs when companies sell goods in foreign markets below their domestic prices or production costs to gain market share and outcompete local industries.

2. The Impact of Dumping in the U.S. Market

At $500 per ton, Chinese steel is significantly cheaper than domestically produced U.S. steel, which also sells for $700 per ton. This gives Chinese exporters an unfair price advantage, harming U.S. steel producers who struggle to compete. If left unchecked, dumping could force domestic companies out of business, leading to job losses and economic instability in the local industry.

3. U.S. Government’s Response: Anti-Dumping Duty

To counteract the effects of dumping, the U.S. government imposes a 40% anti-dumping duty on imported Chinese steel. This additional tariff increases the price of Chinese steel from $500 to $700 per ton, eliminating the unfair price advantage.

4. Market Impact and Outcome

Before the anti-dumping duty was imposed, Chinese steel was sold at $500 per ton, creating an unfair price advantage and undercutting U.S. producers. However, after the implementation of a 40% anti-dumping tariff, the price of Chinese steel in the U.S. increased to $700 per ton, bringing it in line with domestic market prices. This adjustment helped restore fair competition and protected U.S. steel manufacturers from artificially low-priced imports.

5. Key Takeaways

Dumping refers to the practice of selling goods in foreign markets at unfairly low prices, often below production costs or domestic market prices. To counteract the negative effects of such pricing strategies, governments impose anti-dumping tariffs to correct price distortions and safeguard domestic industries. In this case, the U.S. government applied a 40% anti-dumping duty on Chinese steel to ensure fair market conditions and prevent potential harm to its domestic steel producers.

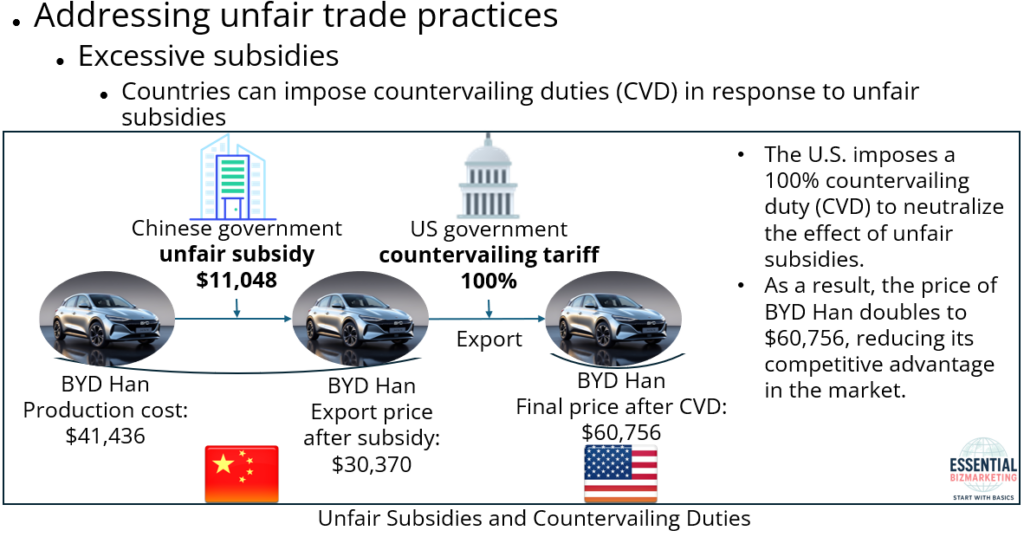

Similarly, if a country provides unfair subsidies to its industries, affected nations can respond by imposing countervailing duties to level the playing field.

The image illustrates how Countervailing Duties (CVD) function as a trade policy tool to counteract unfair subsidies. It focuses on the case of BYD Han, a Chinese electric vehicle (EV), and the impact of Chinese government subsidies and U.S. trade policy responses.

1. Unfair Subsidies from the Chinese Government

The Chinese government provides unfair subsidies to its domestic EV industry, lowering production costs for companies like BYD. In this case, BYD Han has a production cost of $41,436, but due to a $11,048 government subsidy, the final price is artificially reduced to $30,370 for export. This creates a price distortion in international markets, giving Chinese EVs an unfair advantage over competitors.

2. Export to the U.S. and Countervailing Duties (CVD)

When BYD Han is exported to the U.S., its subsidized price of $30,370 makes it significantly cheaper than it would be without government support. To offset the effects of the unfair subsidy, the U.S. government imposes a 100% countervailing duty (CVD) on the vehicle.

3. Price Adjustment and Market Impact

After the 100% CVD is applied, the final price of BYD Han in the U.S. rises to $60,756. This eliminates the price advantage that was created by the Chinese subsidies, making the vehicle less competitive in the market. The application of CVD ensures fair competition by preventing foreign government subsidies from distorting prices and harming domestic industries.

4. Key Takeaways

- Unfair subsidies reduce production costs and artificially lower export prices.

- Countervailing duties (CVDs) are imposed to neutralize these subsidies and ensure fair trade.

- BYD Han’s price increases after CVD, removing its unfair cost advantage in the U.S. market.

This case highlights how governments use CVDs to protect domestic industries from trade distortions caused by foreign subsidies, maintaining a level playing field in global trade.

Another major initiative under the WTO is the Doha Round, which was launched in 2001 with the goal of further reducing trade barriers and assisting developing nations. However, progress has been slow due to disagreements between rich and poor countries, particularly concerning agricultural subsidies and tariff reductions.

6. Conclusion

Government intervention in trade is driven by a mix of political, economic, and cultural factors. While trade restrictions can protect domestic industries and preserve national interests, they may also lead to inefficiencies, higher prices, and retaliation from other nations. The global trading system, particularly through organizations like the WTO, seeks to balance the benefits of free trade with the need for fair competition. Understanding these dynamics is essential for businesses and policymakers navigating the complexities of international trade.

Related videos

- Trade Barriers: Tariffs and Quotas

- Title: Import Quotas

- WTO Policies and Their Role in International Trade

- Anti-Dumping Measures and Countervailing Duties

- Recent Economic Policies Affecting Global Trade

- Trade Disputes Involving Major Economies

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.