Case Study: Volkswagen Group

Volkswagen Group, headquartered in Germany, is a global automotive powerhouse owning 10 prestigious brands including Audi, Bentley, and Porsche. Operating through 48 production facilities worldwide, VW sells approximately 8 million vehicles annually to over 150 countries, with particularly strong market presence in China (accounting for 30% of sales) and South America. The company is pursuing aggressive US market expansion by adapting designs to American preferences, reducing prices, and increasing cost-effective production capacity.

VW implements an innovative modular production strategy that enables the use of identical key components across 16 different vehicle models and seven million units, reducing development and parts costs by 20% while decreasing production time by 30%. Following diesel emissions violations, VW committed to investing $2 billion in US electric vehicle infrastructure by 2028. The company has historically benefited from government protection through the “VW Law,” which allowed the German state of Lower Saxony (20.1% owner) to block takeovers threatening local jobs, highlighting the close relationship between German government and corporate management. The passage concludes by introducing foreign direct investment concepts, explaining the international movement of production factors and capital flows across borders.

1. Introduction to Foreign Direct Investment

Foreign direct investment (FDI) occurs when a company invests in physical assets or obtains a significant share of ownership in a company located in another country. The primary reason for FDI is to gain management control over operations abroad. This is different from portfolio investment, which involves financial assets without acquiring managerial influence.

Companies engage in FDI to expand their market presence, increase efficiency, and access resources that may not be available domestically.

2. Global Patterns of FDI

FDI has experienced significant fluctuations over the past few decades. The 1990s saw rapid growth, followed by a decline in the early 2000s due to economic downturns. However, globalization and the rise of international mergers and acquisitions have continued to drive FDI. Developing nations, particularly in Asia, have attracted an increasing share of FDI, with China and India emerging as major destinations.

Developed countries such as the United States, Japan, and members of the European Union also receive a substantial portion of FDI due to their stable business environments and advanced infrastructure.

3. Theories Explaining FDI

Several theories attempt to explain why companies choose to engage in FDI rather than relying on exports, licensing, or other forms of international business expansion. These theories provide insights into the strategic motivations behind FDI and help explain why firms prefer direct investment over alternative market entry methods.

3.1. International Product Life Cycle Theory

The international product life cycle theory, developed by Raymond Vernon, explains FDI by examining how a product evolves from its introduction to its eventual standardization. According to this theory, a company initially produces and exports a product from its home country. However, as the product matures and demand increases in foreign markets, the firm eventually establishes production facilities abroad.

This theory divides the product life cycle into three stages. In the new product stage, the company develops and manufactures the product domestically because demand is uncertain, and proximity to the research and development team is essential. As the product enters the maturing product stage, demand increases in foreign markets, making it more cost-effective to establish FDI in key locations rather than continuing to export. Finally, in the standardized product stage, the product reaches mass production, and competition intensifies. Companies relocate production to low-cost countries to maintain profitability, further driving FDI.

A clear example of this theory is the personal computer industry. Initially, computers were produced and exported from the United States, but as demand grew worldwide, production moved to other developed countries. Eventually, companies relocated manufacturing to lower-cost countries such as China to remain competitive.

Although this theory explains the shift from exporting to FDI, it does not fully address why firms choose FDI over licensing or strategic alliances, particularly in cases where production efficiency can be maintained without physical relocation.

3.2. Market Imperfections Theory

The market imperfections theory, also known as the internalization theory, suggests that firms engage in FDI to bypass inefficiencies in international markets. Market imperfections arise when barriers prevent smooth transactions between buyers and sellers, making it more efficient for firms to internalize operations rather than rely on external market exchanges.

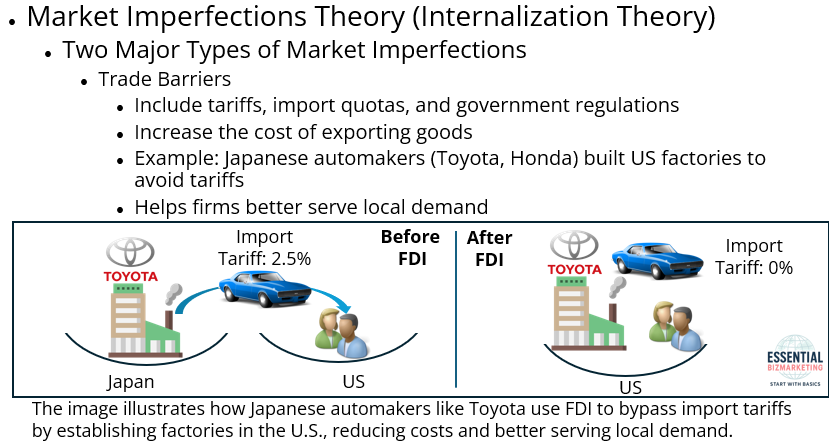

Two major types of market imperfections drive FDI. The first is trade barriers, such as tariffs, import quotas, and government regulations, which can increase the cost of exporting goods. To avoid these costs, firms establish production facilities in foreign countries. A well-known example is the automotive industry. Japanese car manufacturers such as Toyota and Honda built factories in the United States to avoid tariffs on imported cars and better serve local demand.

The image illustrates how Japanese automakers, such as Toyota, use Foreign Direct Investment (FDI) to overcome trade barriers. On the left side, cars exported from Japan to the U.S. are subject to a 2.5% import tariff, increasing costs. On the right side, Toyota establishes a factory in the U.S., allowing them to produce cars locally and avoid import tariffs (0%). This strategy enables firms to reduce costs and better serve local demand.

The second major market imperfection is specialized knowledge. Some firms possess unique technical expertise, innovative processes, or brand recognition that cannot be easily transferred through licensing. If a company licenses its technology to a foreign firm, it risks losing competitive advantage or unintentionally creating a future competitor. To prevent this, firms often prefer to internalize operations through FDI. This is evident in the semiconductor industry, where companies like Intel and Samsung establish wholly owned foreign subsidiaries rather than licensing their chip-making technologies to external manufacturers.

3.3. Eclectic Theory (OLI Paradigm)

The eclectic theory, developed by John Dunning, provides a comprehensive framework for understanding FDI decisions. Also known as the OLI paradigm, this theory suggests that firms undertake FDI when three advantages—ownership, location, and internalization—are present simultaneously.

Ownership advantage refers to unique assets that give a firm a competitive edge over local firms. These assets can include brand reputation, advanced technology, or managerial expertise. A global brand such as McDonald’s benefits from its strong reputation and established operational expertise, making it easier to succeed in foreign markets.

Location advantage relates to the specific benefits that a host country offers, making it an attractive destination for FDI. These benefits may include access to natural resources, a skilled workforce, or proximity to key markets. Oil companies, for instance, invest in Middle Eastern countries because of their abundant petroleum reserves.

Internalization advantage explains why firms choose FDI over licensing or outsourcing. When managing operations internally is more efficient than relying on external contracts, firms prefer to invest directly. This advantage is particularly relevant in industries where quality control, intellectual property protection, or supply chain coordination are critical.

The eclectic theory is widely accepted because it integrates various aspects of FDI decision-making. It explains why multinational companies select specific countries for investment and why they prefer direct ownership rather than market-based transactions.

3.4. Market Power Theory

The market power theory suggests that firms engage in FDI to establish a dominant position in an industry, increasing their ability to influence prices, control supply chains, and achieve long-term profitability. By expanding through FDI, companies can limit competition and strengthen their market presence.

One key strategy within this theory is vertical integration, where firms control multiple stages of production. There are two forms of vertical integration. Backward integration occurs when a firm acquires or establishes operations in the supply chain to secure raw materials or key inputs. An example of this is Tesla’s investment in lithium mining operations to ensure a stable supply of batteries for its electric vehicles.

Forward integration happens when a firm expands into distribution or retail to strengthen its control over the final product delivery. Apple’s investment in retail stores worldwide allows the company to manage customer experience and pricing more effectively.

By integrating backward or forward, firms reduce dependency on suppliers and distributors, enhancing their market control. The automotive industry illustrates this theory well, as companies such as Toyota, Volkswagen, and Ford establish foreign subsidiaries to manage production, supply chains, and distribution networks efficiently.

4. Key Management Issues in FDI Decisions

When companies decide to invest in foreign markets, they must consider several management challenges. One critical issue is control. Firms often prefer to maintain full ownership to ensure that their foreign operations align with their global strategies. However, some governments require foreign companies to enter joint ventures with local firms to protect domestic industries.

Another major decision involves whether to acquire an existing business or establish a new subsidiary, known as a greenfield investment. Acquiring an existing company can provide immediate access to infrastructure, workforce, and market knowledge, but it may also come with challenges such as outdated equipment or labor disputes. On the other hand, building a new facility allows firms to design operations according to their standards, though it requires more time and investment.

Production costs are another crucial factor in FDI decisions. Labor costs, regulatory requirements, and operational expenses vary across countries. Some firms adopt rationalized production, where different components of a product are manufactured in various locations to minimize costs. Additionally, companies may invest abroad to gain customer knowledge, especially in markets where consumer preferences differ significantly from those in the home country. Some firms also follow their clients into foreign markets to maintain close supplier relationships, while others enter new markets in response to competitors’ moves.

5. Government Intervention in FDI

Governments intervene in FDI to regulate its impact on the national economy. Host countries, which receive foreign investments, implement policies to either encourage or restrict FDI depending on their economic priorities. These policies are designed to balance the benefits of FDI, such as economic growth and job creation, with potential drawbacks, such as excessive foreign influence over domestic industries. Similarly, home countries, where multinational corporations originate, may also intervene in FDI outflows by either supporting or discouraging investments abroad. Their policies are often influenced by concerns about job losses, trade balance, and long-term competitiveness.

5.1. Host Country Policies on FDI

Host countries welcome FDI when it contributes positively to their economic development. To attract foreign investors, they provide various incentives, including tax reductions, financial assistance, and improvements to infrastructure. However, in certain situations, governments may impose restrictions to prevent excessive foreign control over key industries or to protect local businesses from unfair competition.

Encouraging FDI

Governments use several strategies to attract FDI because foreign investments can stimulate economic growth, create employment opportunities, and transfer advanced technology and management expertise.

One common method is offering tax incentives, where foreign investors receive reductions or exemptions on corporate taxes for a specific period. This encourages multinational corporations to set up operations in the host country, as they can benefit from a lower tax burden. For example, Ireland has successfully attracted major technology companies like Google and Apple by maintaining a low corporate tax rate, making it a preferred destination for FDI in the tech industry.

Another method is providing low-interest loans or financial grants to foreign companies willing to invest in key sectors. Governments may allocate public funds to support industries that align with national economic priorities, such as renewable energy, manufacturing, or technology. China, for instance, has used state-backed financial support to attract global automakers to establish electric vehicle production facilities within its borders.

Investing in infrastructure improvements is another way host countries promote FDI. By building modern transportation systems, advanced communication networks, and industrial zones, governments create an environment where businesses can operate efficiently. Singapore, known for its world-class infrastructure and port facilities, has become a major hub for multinational corporations looking to expand their operations in Asia.

Host countries also welcome FDI when it leads to technology transfer and the development of local industries. By allowing foreign companies to operate within their borders, governments hope that local businesses and workers will gain valuable skills and knowledge. South Korea, for example, has successfully leveraged FDI in the semiconductor industry to develop a highly skilled workforce and strengthen its global competitiveness in high-tech manufacturing.

Restricting FDI

Despite its benefits, host countries may impose restrictions on FDI to protect their national interests. One of the most common restrictions is ownership limitations, where foreign investors are prohibited from fully owning companies in specific industries. This policy ensures that local businesses retain control over key sectors, such as telecommunications, energy, and defense. In India, foreign direct investment in the retail sector is limited to prevent multinational corporations from dominating local markets and putting small businesses at risk.

Governments may also enforce performance requirements on foreign investors to ensure that FDI benefits the local economy. These requirements might include mandates for foreign companies to source a certain percentage of materials or labor from domestic suppliers, invest in local research and development, or export a portion of their products. Brazil, for example, has required multinational automobile manufacturers to increase local content in their production processes to stimulate the domestic supply chain.

Additionally, governments may implement regulatory barriers to control foreign investments. These regulations can include lengthy approval processes, environmental protection laws, or restrictions on repatriating profits to the investor’s home country. By imposing such measures, governments seek to maintain economic stability and prevent excessive capital outflows.

5.2. Home Country Policies on FDI

While host countries focus on managing incoming FDI, home countries regulate outbound FDI to balance national economic priorities. Some home governments encourage outward FDI to help their firms expand into global markets, while others impose restrictions to prevent economic harm.

Encouraging Outward FDI

Home countries support outward FDI when it strengthens their multinational corporations and enhances global competitiveness. One way they do this is by offering investment insurance, which protects companies against risks such as political instability, expropriation, or currency restrictions in foreign markets. The United States, through the Overseas Private Investment Corporation (OPIC), provides insurance to American businesses investing in emerging economies, reducing the risks associated with FDI.

Governments may also provide loans and loan guarantees to companies looking to invest abroad. These financial supports allow firms to expand internationally without facing significant financial barriers. Germany, for instance, offers financing programs to assist its domestic firms in expanding their production facilities overseas, particularly in developing markets.

Another strategy is the negotiation of special tax treaties with foreign countries to prevent double taxation on foreign earnings. Without these agreements, companies investing abroad may face taxes both in their home country and in the host country, reducing their profitability. Countries like the Netherlands have established favorable tax treaties with multiple nations, making it a preferred base for multinational corporations managing global operations.

Home governments may also engage in diplomatic efforts to persuade other nations to relax investment restrictions for their domestic firms. Trade agreements often include investment provisions that make it easier for multinational corporations to establish operations abroad. The European Union, for example, has actively worked to ensure that its member states benefit from fair investment conditions in global markets.

Restricting Outward FDI

Despite the advantages of outward FDI, home governments may impose restrictions when they believe it harms their domestic economy. One major concern is the loss of domestic jobs when companies relocate production to lower-cost countries. To prevent excessive job outsourcing, governments may introduce policies that penalize firms for moving operations abroad. In the United States, some lawmakers have proposed tax penalties for companies that offshore manufacturing jobs while benefiting from government subsidies.

Another reason for restricting outward FDI is trade balance protection. When companies shift production overseas, the home country may experience a decline in exports, leading to trade deficits. To counter this, some governments impose higher tax rates on foreign earnings, discouraging companies from moving capital abroad. Japan has implemented tax policies that encourage its corporations to reinvest profits within the country rather than expanding overseas.

Home governments may also impose sanctions on specific countries, preventing firms from investing in regions that are politically or economically unstable. These restrictions are often used as a tool to exert political pressure or comply with international regulations. For example, the United States and the European Union have imposed sanctions on certain industries in Russia, restricting foreign investments in the energy and defense sectors.

5.3. Balancing FDI Policies

Governments must carefully design their FDI policies to balance economic benefits with potential risks. Host countries must weigh the advantages of FDI, such as job creation and technological advancement, against the need to protect domestic industries and maintain national sovereignty. At the same time, home countries must consider how outward FDI impacts employment, trade balances, and long-term competitiveness.

Effective FDI policies often involve a mix of incentives and regulations to ensure that foreign investments align with national economic goals. By strategically managing FDI, governments can maximize economic growth while safeguarding their domestic interests. Understanding these policies is crucial for businesses looking to expand internationally, as navigating government regulations can significantly impact the success of their foreign investments.

6. Conclusion

FDI plays a crucial role in global business by enabling companies to expand operations, access new markets, and improve efficiency. Theories such as the international product life cycle, market imperfections, eclectic theory, and market power provide different perspectives on why firms engage in FDI. While businesses consider factors such as control, production costs, and customer preferences in their FDI decisions, governments influence FDI through incentives and restrictions. Understanding these dynamics helps businesses navigate the complexities of international investment and make informed strategic decisions.

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.