Case study: Nesle’s Global Recipe

Nestlé, the world’s largest food company, operates globally, earning only a small fraction of its revenue in Switzerland. It successfully transforms everyday products into global brands and expands regional products into international markets. For example, it introduced a cereal bar for diabetics in Asia before launching it worldwide. Recognizing the cultural significance of food, Nestlé carefully adapts to local dietary traditions and has learned from past mistakes, such as ensuring the safe use of baby milk formulas in developing nations.

Sustainability is a key concern for Nestlé. Under pressure from Greenpeace, it stopped sourcing palm oil from environmentally sensitive areas and now uses only certified sustainable palm oil. Additionally, the company has committed to reducing sugar in its snack foods by 40% to enhance nutritional value.

Nestlé must also navigate regulatory environments, such as EU competition laws and environmental policies. When partnering with Coca-Cola to develop coffee and tea drinks, it had to ensure compliance with EU competition regulations. The company also collaborates with governments to manage packaging waste and develop waste-recovery programs.

Regional trade agreements significantly impact global businesses like Nestlé by lowering trade barriers, making new markets more accessible, and increasing competition. While these agreements create opportunities for companies to expand internationally, they also expose them to greater competition in domestic markets. The chapter concludes by examining the effects of regional economic integration, discussing its levels, and evaluating both its benefits and challenges.

1. Introduction

Regional economic integration refers to the process in which neighboring countries work together to remove or reduce barriers to trade, labor movement, and capital flow. The goal of such integration is to enhance economic cooperation, increase market efficiency, and strengthen political ties among member nations.

While integration can lead to economic growth, increased trade, and greater political stability, it also presents challenges, including job displacement and concerns over national sovereignty.

2. Levels of Economic Integration

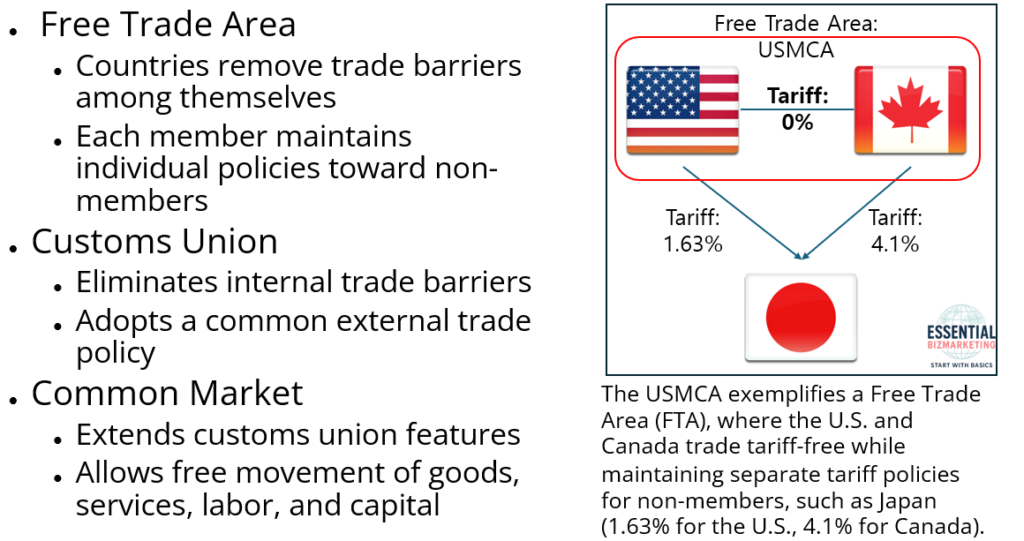

Countries integrate their economies at different levels, progressing from minimal cooperation to full political union. The most basic form of integration is a free trade area, where countries remove trade barriers among themselves while maintaining individual policies toward non-members. A customs union represents a deeper level of integration, as member countries not only eliminate internal trade barriers but also adopt a common external trade policy.

A Free Trade Area (FTA) is a trade agreement where member countries remove trade barriers among themselves while maintaining independent trade policies toward non-members. The United States-Mexico-Canada Agreement (USMCA) exemplifies this concept, as the U.S. and Canada have eliminated tariffs on trade between them

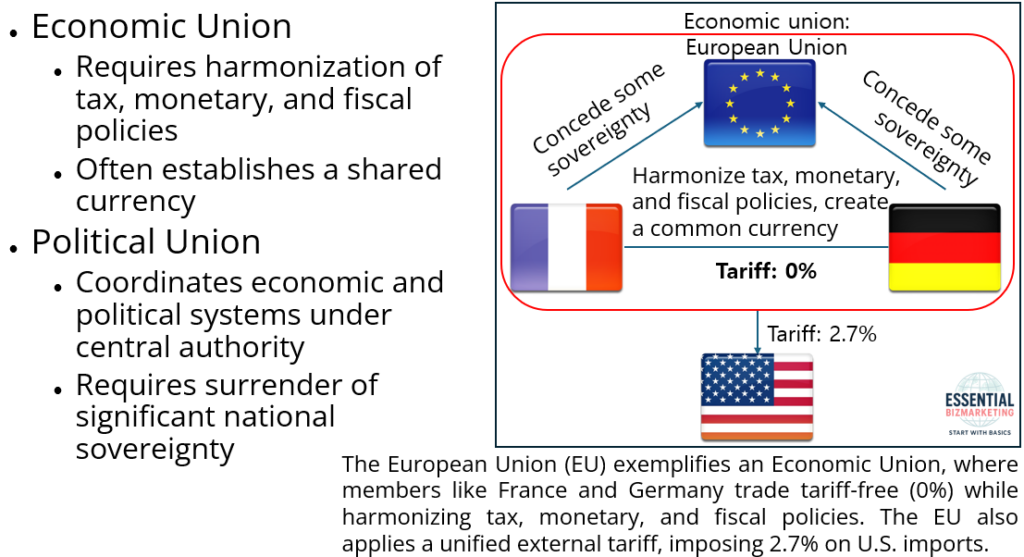

An Economic Union represents a high level of economic integration, requiring member states to harmonize tax, monetary, and fiscal policies while often adopting a shared currency. The image below illustrates this concept using the European Union (EU) as an example.

In the EU, countries like France and Germany trade freely with each other without tariffs (0%), demonstrating the removal of internal trade barriers. Additionally, they concede some national sovereignty to EU institutions, allowing for coordinated economic policies. This level of integration enables economic stability and efficiency across member states.

Beyond internal trade, an Economic Union also implements a common external trade policy, meaning that all member states apply the same tariffs to non-member countries. In this case, the EU imposes a 2.7% tariff on imports from the United States, reflecting its unified approach to external trade regulation.

The benefits of regional integration include increased trade, political cooperation, and economic stability. However, it can also lead to trade diversion, which occurs when a country within a trading bloc is favored over a more efficient non-member producer due to tariff advantages. Additionally, integration can create concerns about the loss of national decision-making power as economic policies become more aligned with regional governance.

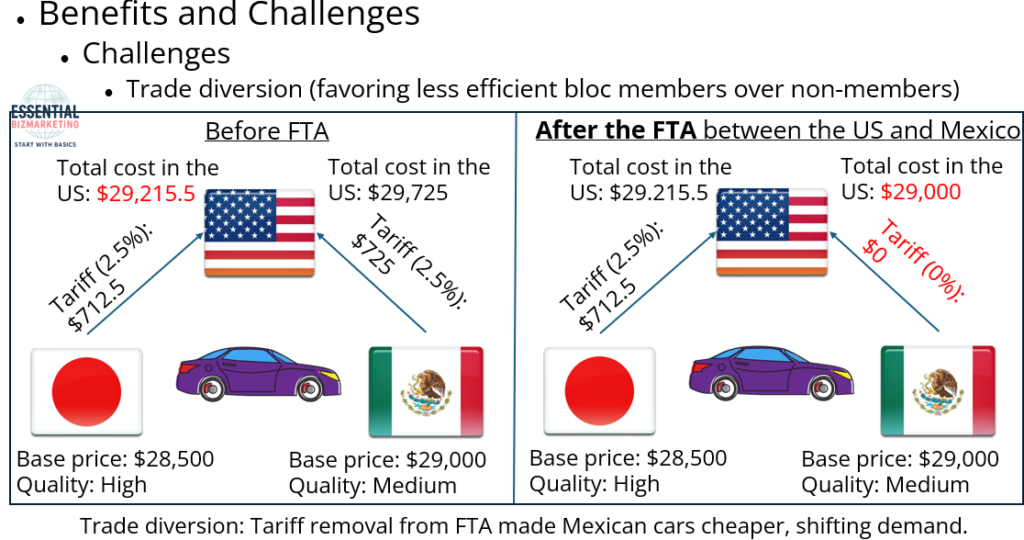

Trade diversion: The image illustrates the concept of trade diversion caused by the implementation of a Free Trade Agreement (FTA) between the United States and Mexico. It compares the cost of importing cars from Japan and Mexico before and after the trade agreement, highlighting how tariff changes influence consumer choices.

Before the FTA, the Japanese car had a base price of $28,500, and due to a 2.5% import tariff, an additional $712.5 was added, bringing the total cost in the U.S. market to $29,215.5. The Mexican car, on the other hand, had a base price of $29,000 and was also subject to the same 2.5% tariff, resulting in an added cost of $725. This made the final price of the Mexican car $29,725. Since the Japanese car was both cheaper and of higher quality compared to the Mexican alternative, it was the more competitive option for American consumers.

After the FTA was implemented, the tariff on Mexican cars was completely eliminated, while the 2.5% tariff remained in place for Japanese cars. This change meant that the final price of the Japanese car stayed the same at $29,215.5, whereas the Mexican car, now free from import duties, was available at its base price of $29,000. As a result, the Mexican car became slightly cheaper than the Japanese car despite its lower quality. This shift in relative prices encouraged American consumers to purchase more Mexican cars instead of Japanese ones.

The image effectively demonstrates how trade diversion occurs when a country enters into a free trade agreement that eliminates tariffs for member nations while keeping them in place for non-member countries. Even though the Japanese car remains of higher quality and was previously the more economical choice, the new tariff structure makes the Mexican car the cheaper option, leading to a shift in consumer preference. This example illustrates how trade policies can distort market efficiency by favoring regional trade partners over more competitive global producers.

3. Integration in Europe

The most advanced example of regional integration is found in Europe, where the European Union (EU) has evolved into a sophisticated economic and political bloc. The EU originated from the European Coal and Steel Community, which was established in 1951 to facilitate trade in key industries and prevent future conflicts. In 1957, the Treaty of Rome created the European Economic Community, setting the foundation for a common market. Over the years, the EU expanded its scope and membership, eventually adopting its current name in 1993.

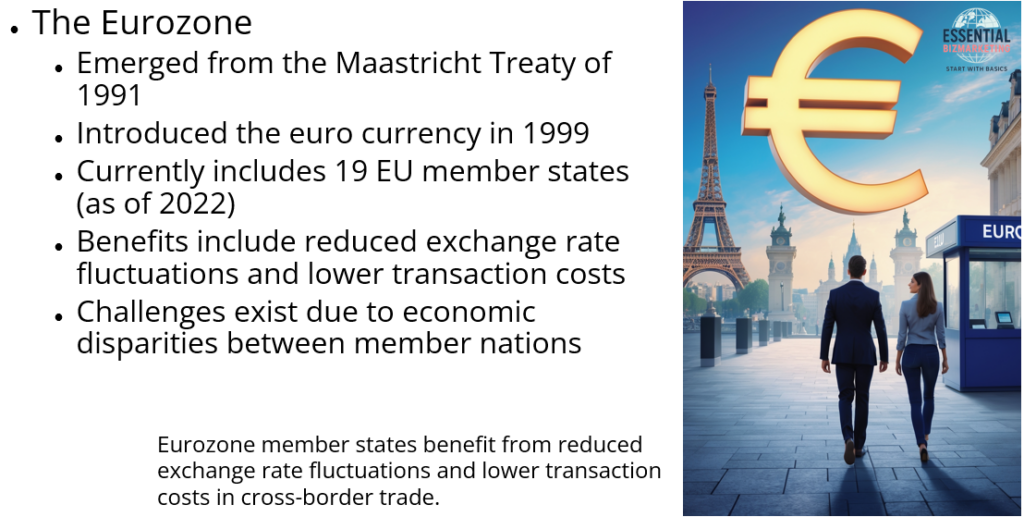

One of the EU’s most significant achievements is the creation of the Eurozone, which emerged from the Maastricht Treaty of 1991. This treaty laid the groundwork for a single European currency, the euro, which was introduced in 1999. Nineteen EU member states currently use the euro, benefiting from reduced exchange rate fluctuations and lower transaction costs in cross-border trade. However, the monetary union also presents challenges, as economic disparities among member nations have occasionally led to financial crises that required collective intervention.

Not all European countries joined the EU. Some, including Norway and Switzerland, chose to remain outside the union while participating in the European Free Trade Association (EFTA). This organization allows its members to engage in trade with EU nations without fully committing to the political and economic requirements of EU membership.

4. Integration in the Americas

Economic integration has also taken place in the Americas, albeit at a slower pace than in Europe. One of the most well-known trade agreements in this region is the North American Free Trade Agreement (NAFTA), which was signed by Canada, the United States, and Mexico in 1994. NAFTA aimed to eliminate tariffs and trade barriers among its member countries, creating a large and efficient market. In 2020, NAFTA was replaced by the United States-Mexico-Canada Agreement (USMCA), which updated trade rules and strengthened labor and environmental protections.

The impact of NAFTA and USMCA has been significant. Trade among the three participating nations increased substantially, and businesses benefited from improved market access. However, some industries experienced job losses as production moved to Mexico, where labor costs were lower. Additionally, environmental concerns arose due to the expansion of industrial activity across borders.

Beyond NAFTA and USMCA, several other trade agreements exist in the Americas. The Central American Free Trade Agreement (CAFTA-DR), established in 2006, connects the United States with six Central American nations. The Andean Community (CAN) focuses on trade cooperation among Bolivia, Colombia, Ecuador, and Peru.

Meanwhile, the Southern Common Market, known as MERCOSUR, includes Argentina and Brazil as key members and has become the most influential trade bloc in South America. The Caribbean Community (CARICOM) and the Central American Common Market (CACM) also facilitate trade among smaller nations in the region.

5. Integration in Asia and Other Regions

Economic integration efforts in Asia have generally been more loosely structured compared to those in Europe and the Americas. The Asia-Pacific Economic Cooperation (APEC) was established in 1989 and now includes twenty-one member economies, such as the United States, China, and Japan. Unlike traditional trade agreements, APEC focuses on economic cooperation rather than forming a structured trading bloc.

The Association of Southeast Asian Nations (ASEAN) was founded in 1967 with the goal of promoting economic and political stability among ten Southeast Asian nations. Over time, ASEAN has grown to become a significant force in the region, with China, Japan, and South Korea collaborating closely with its member states. These partnerships have helped ASEAN countries strengthen their global trade positions while maintaining regional stability.

In the Middle East, the Gulf Cooperation Council (GCC) was formed in 1980 by six countries, including Saudi Arabia and the United Arab Emirates. The GCC facilitates economic and political cooperation, allowing for free travel and investment among member nations. In Africa, the African Union (AU) was established in 2002 to promote political and economic unity among fifty-five African nations. Similarly, the Economic Community of West African States (ECOWAS) aims to enhance trade among West African countries but faces challenges such as political instability and underdeveloped infrastructure.

6. Conclusion

Regional economic integration plays a crucial role in shaping global trade and economic policies. By reducing trade barriers and fostering cooperation, integration leads to increased efficiency and economic growth. However, it also presents challenges, including shifts in employment, trade imbalances, and concerns over national sovereignty. The success of economic integration depends on how well countries manage these benefits and challenges while ensuring that their economies remain competitive in the global market. As globalization continues to evolve, regional trade agreements will remain a key factor in international business and economic development.

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

Related videos

- Europe: Impact of EU Integration and Trade Policies

- Title: Where did Brexit come from?

- Title: After Brexit

- Americas: Businesses under USMCA/NAFTA

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.