Case study: Wii Is the Champion

Nintendo, founded in 1889 by Fusajiro Yamauchi as a playing card manufacturer in Kyoto, Japan, has evolved into a global video gaming powerhouse. Since 1989, the company has been a significant player in the gaming industry, producing popular mobile and home gaming systems including Switch, Wii, Nintendo DS, GameCube, and Game Boy Advance, featuring iconic characters like Mario, Donkey Kong, and Pokémon.

The Wii revolutionized the gaming industry with its innovative features such as wireless motion-sensitive controllers, built-in Wi-Fi, and fitness applications like Wii Fit, which offers various exercise programs. Nintendo sold over 100 million Wii units worldwide.

The newer Switch gaming system offers versatility by allowing players to use it both at home and on the go. Its popularity led to retail shortages, with stores selling out within hours of receiving shipments.

Beyond marketing and game design, Nintendo’s financial performance is significantly affected by currency exchange rates. When converting the earnings of international subsidiaries into Japanese yen, a strong yen can decrease Nintendo’s stated earnings. In a recent annual report, Nintendo posted a net income of ¥257.3 billion ($2.6 billion), which included a substantial foreign exchange loss of ¥92.3 billion ($923.5 million).

1. Importance of the International Capital Market

The international financial market plays a crucial role in the global economy by providing companies, governments, and individuals with access to capital. This chapter explores the structure and functions of the international capital market and the foreign exchange market, as well as the mechanisms used for currency transactions.

The international capital market is a system that connects investors and borrowers across different countries. Its primary functions include expanding the money supply for borrowers, lowering borrowing costs, and reducing investment risks.

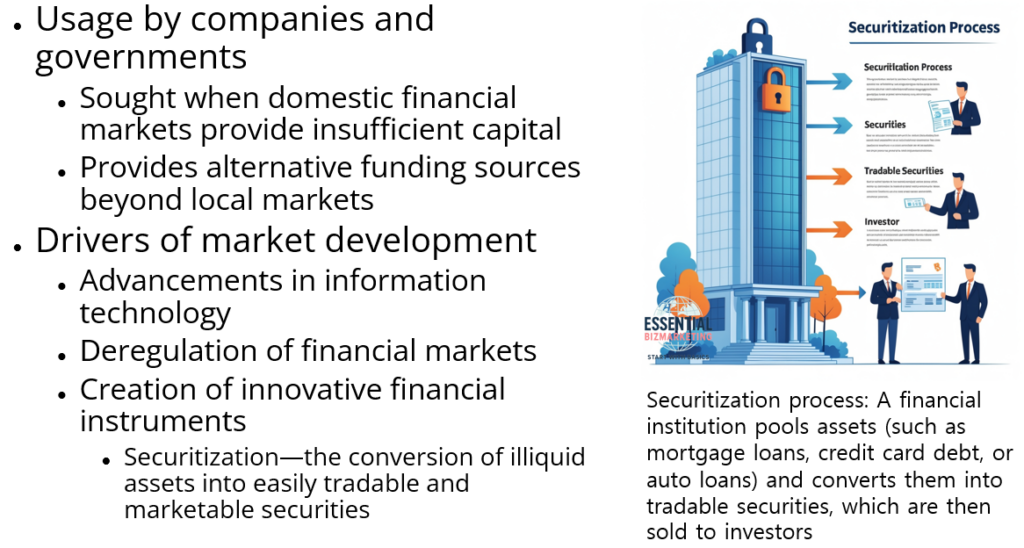

Companies and governments seek funds from this market when they cannot secure sufficient capital in their domestic financial markets. The development of this market has been driven by advancements in information technology, deregulation of financial markets, and the creation of innovative financial instruments.

Financial centers such as London, New York, and Tokyo dominate international finance. Offshore financial centers, like the Cayman Islands and Switzerland, also play a role by offering low taxes and fewer regulations, attracting investors seeking financial efficiency.

2. Components of the International Capital Market

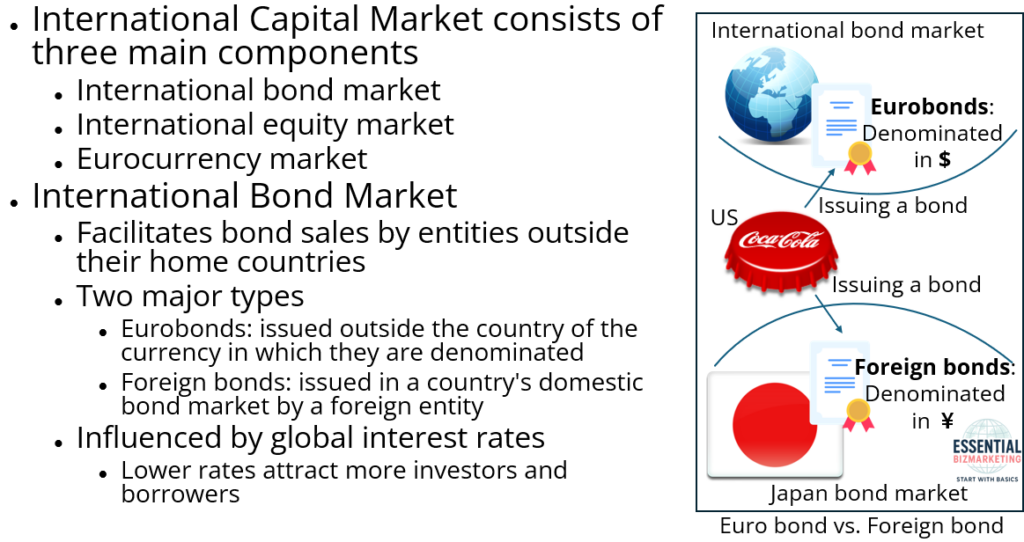

The international capital market consists of three main components: the international bond market, the international equity market, and the Eurocurrency market.

The international bond market facilitates the sale of bonds by companies, governments, and other entities outside their home countries. There are two major types of international bonds: Eurobonds, which are issued outside the country of the currency in which they are denominated, and foreign bonds, which are issued in a country’s domestic bond market but by a foreign entity. The bond market is influenced by global interest rates, with lower rates attracting more investors and borrowers.

The international equity market allows companies to raise capital by selling stocks outside their home countries. This market has grown due to privatization, economic expansion in emerging markets, and technological advancements such as electronic stock exchanges. Investment banks facilitate transactions by connecting buyers and sellers across global markets.

The Eurocurrency market involves the deposit and lending of currencies outside their country of origin. For example, US dollars deposited in a European bank are known as Eurodollars. This market is largely unregulated, which reduces costs but also increases risks. The London Interbank Offer Rate (LIBOR) is a key benchmark for interest rates in this market.

3. Functions of the Foreign Exchange Market

The foreign exchange (forex) market enables the conversion of currencies for international trade and investment. Its primary functions include currency conversion, hedging against exchange rate fluctuations, arbitrage, and speculation.

Currency conversion is essential for global business transactions. For instance, a company in France purchasing goods from a US supplier must convert euros into US dollars.

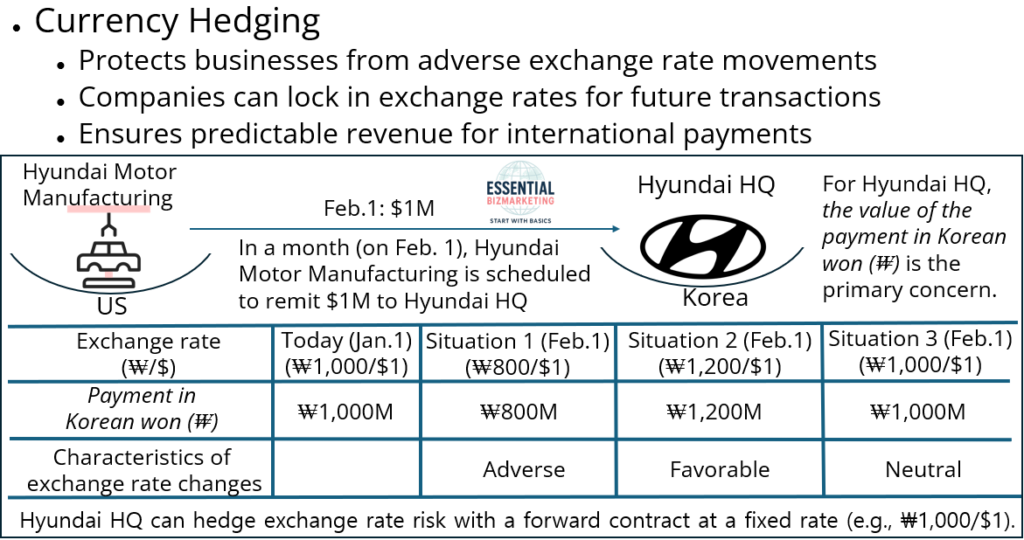

Hedging helps businesses protect themselves from adverse exchange rate movements. A company expecting payment in a foreign currency at a future date may enter into a contract to lock in an exchange rate, ensuring predictable revenue.

The diagram illustrates how Hyundai Motor Manufacturing in the U.S. remits a payment of $1 million to Hyundai HQ in Korea and the impact of exchange rate fluctuations on the value of this payment in Korean won. The key concern for Hyundai HQ is the amount it receives in won, which varies depending on the exchange rate at the time of the transaction.

Currently, on January 1, the exchange rate is ₩1,000 per dollar, meaning that Hyundai HQ would receive ₩1,000 million for the $1 million remittance. However, if the exchange rate on February 1 changes, the value of the payment will also change. In an adverse scenario where the exchange rate drops to ₩800 per dollar, Hyundai HQ would receive only ₩800 million, leading to a loss due to a weaker won. On the other hand, if the exchange rate increases to ₩1,200 per dollar, Hyundai HQ would receive ₩1,200 million, benefiting from a stronger won. If the exchange rate remains at ₩1,000 per dollar, the payment remains unchanged at ₩1,000 million.

To mitigate the uncertainty caused by exchange rate fluctuations, Hyundai HQ can enter into a forward contract with a bank. This contract allows Hyundai to lock in a predetermined exchange rate, such as ₩1,000 per dollar, ensuring that the amount received remains stable regardless of future changes in the exchange rate. By doing so, Hyundai HQ can protect itself from unfavorable currency movements and maintain predictable revenue from international transactions.

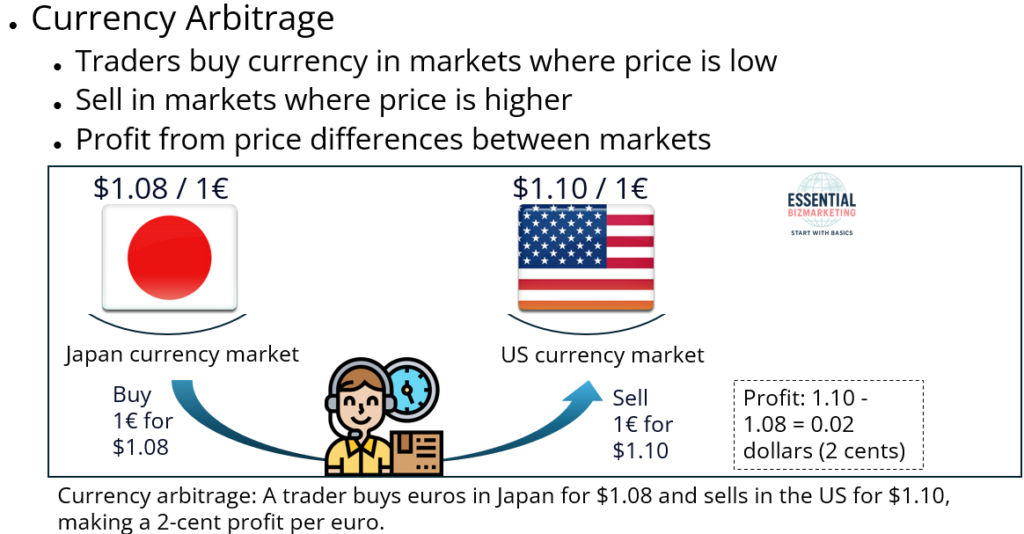

Arbitrage occurs when traders buy currency in one market where the price is low and sell it in another market where the price is higher, making a profit from the difference.

This image illustrates the concept of arbitrage in the foreign exchange market. Arbitrage occurs when traders buy currency in a market where the price is lower and sell it in a market where the price is higher, allowing them to profit from price differences between markets.

In the diagram, the Japanese currency market offers one euro (€) for $1.08, while the US currency market values the same euro at $1.10. A trader purchases one euro in Japan for $1.08 and then sells it in the US for $1.10, making a profit of $0.02 (2 cents) per euro.

The diagram visually represents this process with arrows indicating the flow of the transaction between Japan and the United States. A trader icon symbolizes the individual executing the transaction, while national flags clearly differentiate the two markets. The profit calculation, shown in the bottom right corner, emphasizes the financial gain derived from the exchange rate discrepancy. This visual effectively conveys the fundamental principle of currency arbitrage in a simple and intuitive manner.

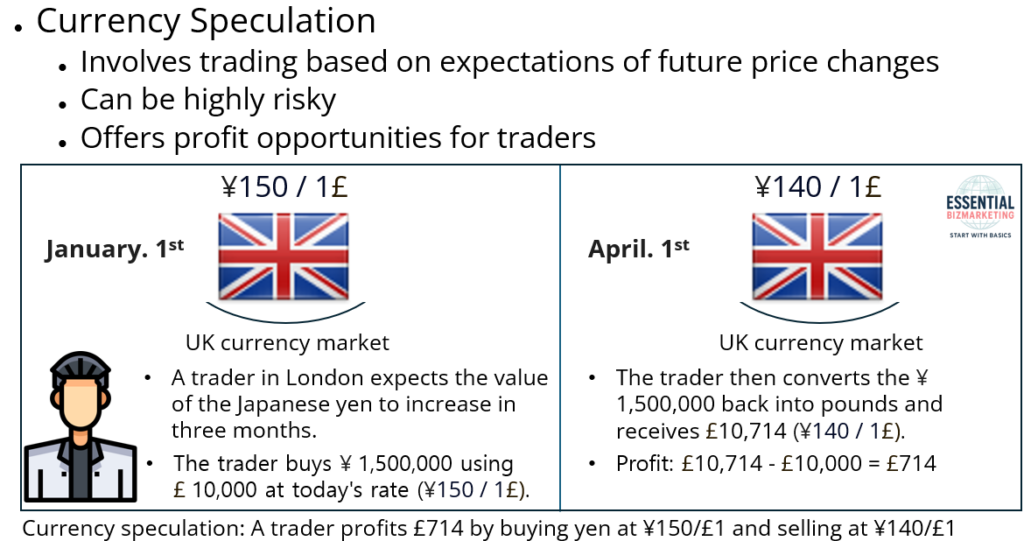

Speculation involves buying and selling currencies based on expectations of future price changes. This can be highly risky but also offers opportunities for profit.

The lower part of the image illustrates a currency speculation scenario using an example of a trader in London predicting an increase in the value of the Japanese yen over a three-month period.

On January 1st, the exchange rate is ¥150 per £1 in the UK currency market. Anticipating that the yen will appreciate, the trader buys ¥1,500,000 using £10,000 at this rate.

On April 1st, the exchange rate has changed to ¥140 per £1, meaning the yen has appreciated against the British pound. The trader then converts the ¥1,500,000 back into pounds and receives £10,714.

The profit from this speculation is calculated as £10,714 – £10,000 = £714. This visual representation effectively demonstrates how currency speculation works, highlighting the potential for profit if exchange rate predictions are accurate.

4. Currency Quotes and Exchange Rates

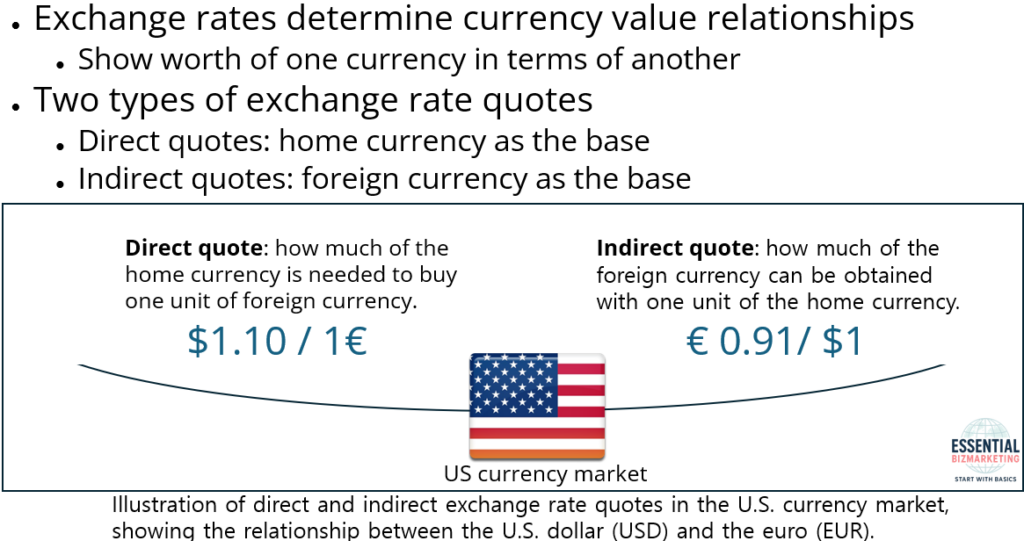

Exchange rates determine how much one currency is worth in terms of another. They can be quoted in two ways: direct quotes, where the home currency is the base, and indirect quotes, where the foreign currency is the base.

The image explains the concept of currency quotes and exchange rates. It begins by stating that exchange rates define the value relationships between currencies, indicating how much one currency is worth in terms of another. The image then introduces two types of exchange rate quotes: direct quotes and indirect quotes.

A direct quote is defined as the amount of home currency required to purchase one unit of foreign currency. In the example provided, the direct quote in the U.S. market is represented as “$1.10 / 1€,” meaning one euro costs 1.10 U.S. dollars. On the other hand, an indirect quote expresses how much of the foreign currency can be obtained with one unit of the home currency. The image presents an example where “$1” is equivalent to “€0.91,” showing that one U.S. dollar can be exchanged for 0.91 euros.

At the bottom of the image, there is a visual representation of the U.S. currency market with an American flag placed in the center. The diagram links the two exchange rate quotes to the U.S. market, emphasizing how direct and indirect quotations function within a specific country’s financial system. The layout clarifies that the method of quoting exchange rates depends on whether the home currency or the foreign currency is used as the base.

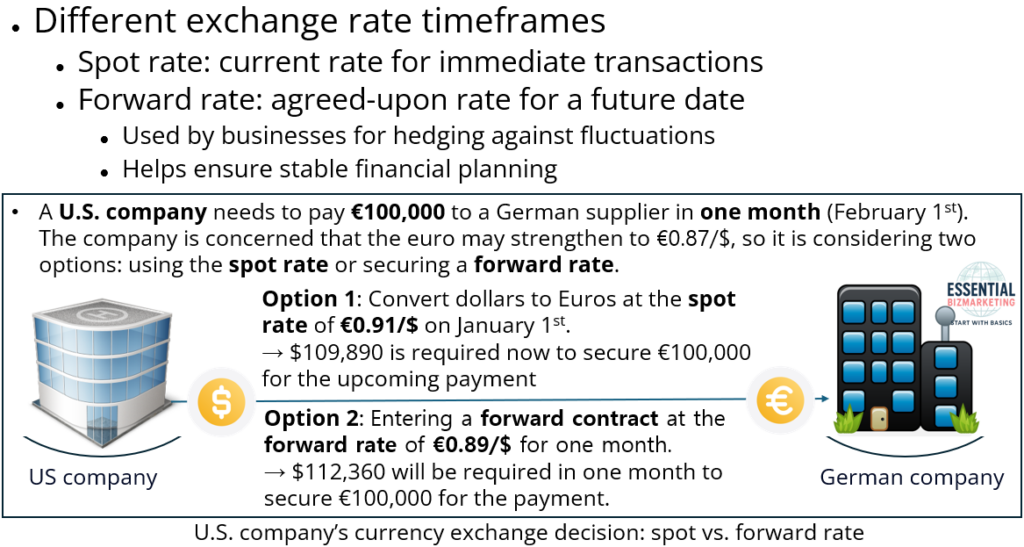

The spot rate refers to the current exchange rate for immediate currency transactions, whereas the forward rate is an agreed-upon exchange rate for a future date. Businesses use forward contracts to hedge against exchange rate fluctuations, ensuring stable financial planning.

The image explains different exchange rate timeframes, focusing on the spot rate and the forward rate. A U.S. company needs to pay €100,000 to a German supplier in one month (February 1st). The company is concerned that the euro might strengthen to €0.87/$, which would make the payment more expensive in U.S. dollars. To manage this risk, the company considers two options: using the spot rate or securing a forward rate.

In Option 1, the company converts dollars to euros immediately at the spot rate of €0.91/$ on January 1st. This means that to obtain €100,000, the company must pay $109,890 at the current exchange rate.

In Option 2, the company enters a forward contract at the forward rate of €0.89/$, agreeing to exchange currency at this rate in one month. When the payment is due on February 1st, the company will need to pay $112,360 to obtain €100,000 at the agreed rate, regardless of market fluctuations.

The illustration visually represents these transactions. On the left side, a modern U.S. company building is shown, symbolizing the business making the payment. In the center, a dollar-to-euro exchange symbol represents the currency conversion process. On the right, a German company building signifies the supplier receiving the payment. The diagram effectively demonstrates how businesses use different exchange rate strategies to manage financial risk.

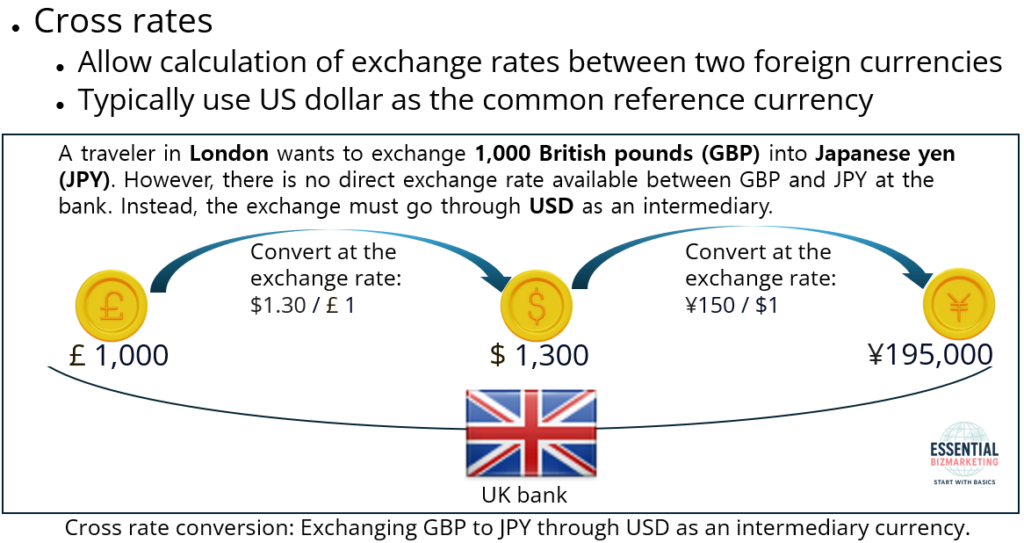

Cross rates allow businesses to calculate the exchange rate between two foreign currencies using a common currency, typically the US dollar.

The lower section of the image visually represents how cross rates work when exchanging between two foreign currencies using an intermediary currency, in this case, the U.S. dollar (USD). A traveler in London wants to exchange 1,000 British pounds (GBP) into Japanese yen (JPY), but the bank does not offer a direct exchange rate between GBP and JPY. Instead, the transaction is processed through USD.

The first step in the exchange process converts £1,000 into USD at the rate of $1.30 per £1, resulting in $1,300. Next, the $1,300 is exchanged into Japanese yen at the rate of ¥150 per $1, yielding a final amount of ¥195,000. The visual elements include currency symbols for pounds, dollars, and yen, along with arrows indicating the step-by-step conversion process. A UK bank is depicted at the bottom to signify the financial institution facilitating the transaction.

5. Instruments and Institutions of the Foreign Exchange Market

The foreign exchange market operates through a network of financial institutions rather than a centralized exchange. Key players include commercial banks, investment banks, and central banks.

The interbank market is where large banks trade currencies among themselves. These transactions help businesses and investors secure the currency they need for international operations.

Securities exchanges facilitate trading in currency futures and options, offering investors tools to manage currency risks.

The over-the-counter (OTC) market allows businesses and investors to trade directly through financial institutions rather than using formal exchanges. This market offers flexibility in customizing currency transactions.

6. Currency Restrictions and Government Policies

Some governments impose restrictions on currency exchange to control economic stability. These measures may include requiring government approval for currency exchange, limiting foreign exchange transactions, and implementing multiple exchange rates for different types of transactions. Countries with weak currencies often enforce these restrictions to protect their economy from capital flight, where investors move money to more stable currencies.

In contrast, freely convertible currencies, such as the US dollar and the euro, can be exchanged without restrictions.

An alternative method for conducting business in restricted markets is countertrade, where goods and services are exchanged instead of using cash transactions.

7. Conclusion

The international financial market is essential for businesses, investors, and governments worldwide. It facilitates global trade, investment, and economic growth while providing tools for managing financial risks. As technology advances and regulations evolve, these markets will continue to adapt to the changing global economic landscape.

Related videos

- International Capital Markets

- Title: Arm IPO on Nasdaq (2023)

- Major Financial Centers

📚 References

Wild, J. J., & Wild, K. L. (2019). International business: The challenges of globalization (9th ed.). Pearson.

📁 Start exploring the Blog

📘 Or learn more About this site

🧵 Or follow along on X (Twitter)

🔎 Looking for sharp perspectives on global trade and markets?

I recommend @GONOGO_Korea as a resource I trust and regularly learn from.